NO.PZ202207040100000601

问题如下:

When comparing factor-based strategies relative to the market-cap weighting of an index, Stapleton’s comments are most likely:选项:

A.incorrect regarding transparency. B.correct. C.incorrect regarding risk exposure.解释:

Solution

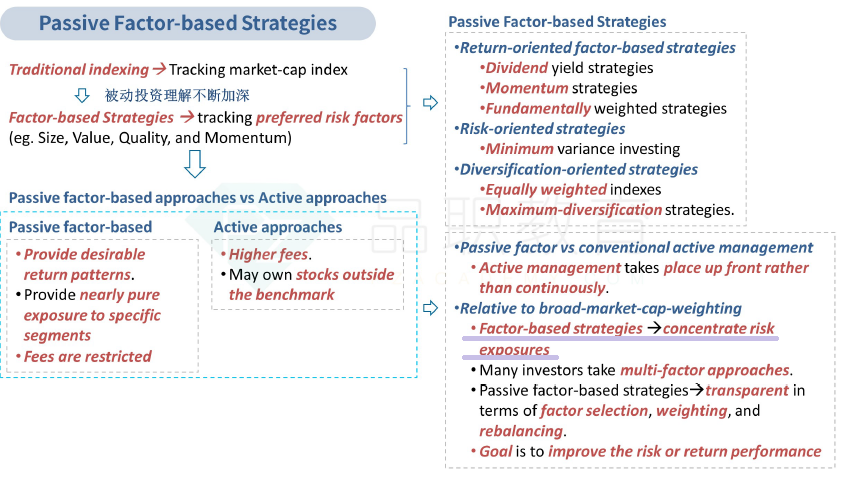

C is correct. Stapleton’s comment is incorrect regarding risk exposure. Relative to broad-market-cap-weighting, passive factor-based strategies tend to concentrate risk exposures, leaving investors exposed during periods when a chosen risk factor is out of favor.

A is incorrect. Stapleton’s comment is correct regarding transparency. Passive factor-based strategies tend to be transparent in terms of factor selection, weighting, and rebalancing. The strategies can be easily replicated by other investors which can produce overcrowding and reduce the realized advantages of a strategy.

B is incorrect. Stapleton’s comment is correct regarding transparency but incorrect regarding risk exposure. Passive factor-based strategies tend to be transparent in terms of factor selection, weighting, and rebalancing. The strategies can be easily replicated by other investors which can produce overcrowding and reduce the realized advantages of a strategy. Relative to broad-market-cap-weighting, passive factor-based strategies tend to concentrate risk exposures, leaving investors exposed during periods when a chosen risk factor is out of favor.

中文解析:

本题考查的是因子策略与市值加权策略的区别。

选项A错误,因为Stapleton指出,因子策略在因子选择、加权和再平衡方面通常具有较高的透明度。因子策略的构建规则公开,投资者可以清楚了解策略的细节,这使得其相比于传统的市场资本加权策略更具透明性。因此,关于透明度的描述是正确的,选项A不成立。

选项B虽然Stapleton正确指出了透明度的问题,但关于因子策略中风险敞口问题的描述是错误的。因子策略可能会将风险集中于某些因子,这些因子在某些市场周期可能不受欢迎,导致投资者在这些时段较高的暴露于风险中。因此,选项B并不完全准确。

选项C是正确的,因子策略相较于市场资本加权策略,通常风险敞口会更加集中,特别是在选定的因子表现不佳时,投资者可能会面临更大的风险敞口。因此,因子策略下这种更加集中的风险敞口能在特定的市场环境下导致不利的表现。正确答案是C。

之前不是说factor base 的方法较传统方法可以更分散吗,因为传统的allocation,资产之间的风险实际上可能会存在重叠。