NO.PZ2017121101000007

问题如下:

A US institutional investor in search of yield decides to buy Italian government bonds for her portfolio but wants to hedge against the risk of exchange rate fluctuations. She enters a cross-currency basis swap, with the same payment dates as the bonds, where at inception she delivers US dollars in exchange for euros for use in purchasing the Italian bonds. The notional principals on the swap are most likely exchanged:

选项:

A.at inception only.

at maturity only

both at inception and at maturity.

解释:

C is correct.

In a cross- currency basis swap, the goals of the transaction are to achieve favorable funding and exchange rates and to swap the foreign currency amounts back to the currency of choice—in this case, the US dollar—at maturity. There is one exchange rate specified in the swap that is used to determine the notional principals in the two currencies, exchanged at inception and at maturity.

中文解析:

在交叉货币互换中,交易的目标是获得有利的资金和汇率,在期初和期末都需要进行货币的互换,且规定了期初和期末的时候交换名义本金的汇率是一样的。

在期间时候,对于dealer而言,是收到了Rjpy,付出Rusd

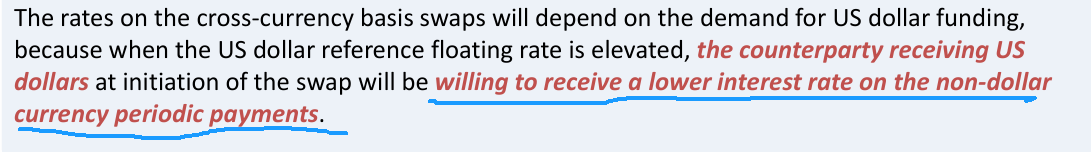

那么如果此时USD的市场需求更强烈,dealer不应该收到价值更高的R(此时basis为负数)才愿意付出USD么?请问老师,这样思考哪里错了