NO.PZ2024092001000020

问题如下:

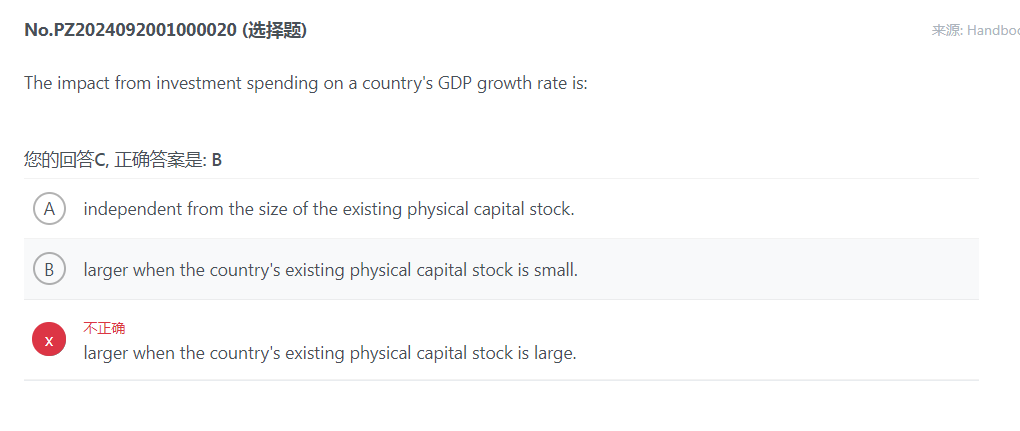

The impact from investment spending on a country's GDP growth rate is:

选项:

A.independent from the size of the existing physical capital stock.

B.larger when the country's existing physical capital stock is small. C.larger when the country's existing physical capital stock is large.解释:

A Incorrect

as the impact of investment spending on available capital depends on the

existing physical capital stock–the smaller the existing capital stock of a

country, the larger the impact on its economic growth rate.

B Correct because although diminishing marginal productivity will eventually limit the

impact of capital deepening, investment-driven growth may last for a

considerable period, especially in countries that start with relatively low

levels of capital per worker. Moreover, the impact of investment spending on

available capital depends on the existing physical capital stock. As with the

share of GDP devoted to investment, the stock of capital available per worker

varies significantly across countries. The wide difference in physical capital

per worker suggests that the positive impact of changes in the physical capital

stock on growth is very significant in developing countries. Mexican workers

have relatively little access to machinery or equipment, so adding even a

little can make a big percentage difference. In developed countries, such as

the United States, Japan, Germany, France, and the United Kingdom, the physical

capital stock is so large that positive net investment in any given year has

only a small percentage effect on the accumulated capital stock. For the

developed countries, a sustained high level of investment over many years is

required to have a meaningful relative impact on the physical capital stock

even though the absolute size of the increase in any given year is still larger

than in the developing countries.

C Incorrect because in

developed countries, such as the United States, Japan, Germany, France, and the

United Kingdom, the physical capital stock is so large that positive net

investment in any given year has only a small percentage effect on the

accumulated capital stock.