NO.PZ2021061002000055

问题如下:

QWR enters a 5-year interest rate swap in which QWR pays the fixed rate of 3% for the first semiannual period and receives an initial six-month MRR of 2.65%.

Based on the

information above, which of the following statements is true?

选项:

A.Three months after the inception of the trade, QWR

has an MTM loss on the swap, because it owes a net settlement payment

to its counterparty.

Three months after the inception of the trade, QWR

has an MTM gain on

the swap, because after the first known net payment to its counterparty, the

remainder of the future cash flows must have a positive present value from QWR's

perspective.

We do not have enough information to determine whether the swap has a positive or negative value from QWR's perspective after the inception of the trade.

解释:

中文解析

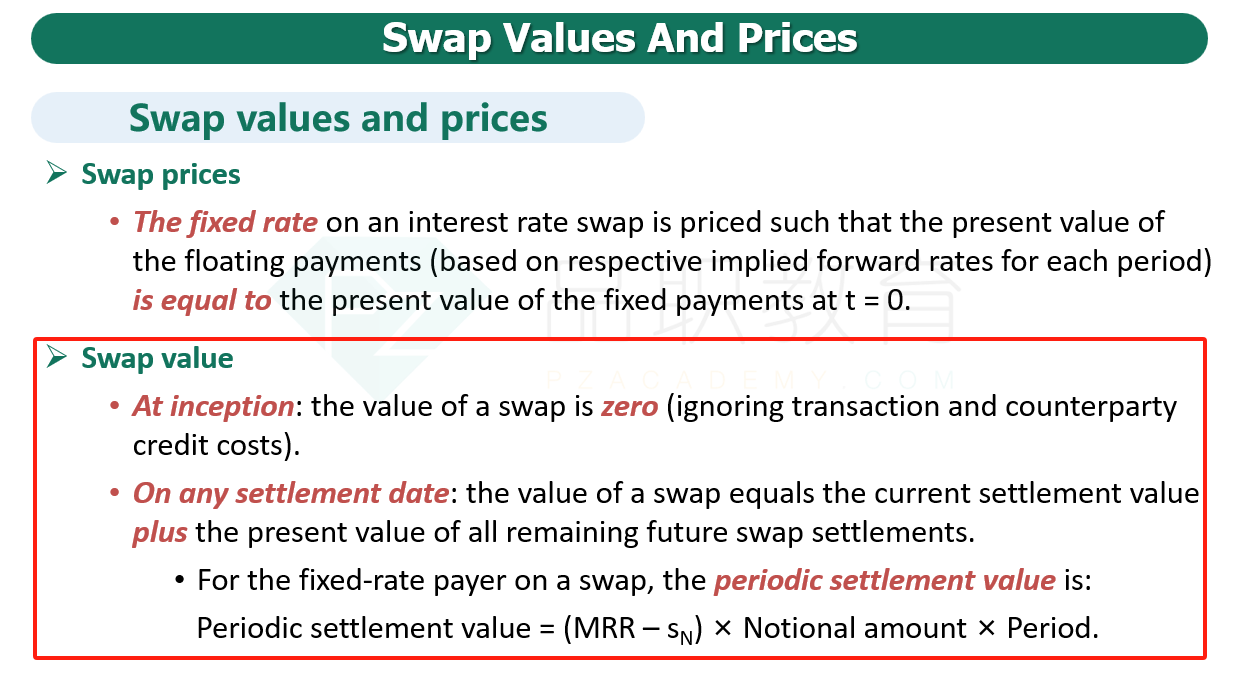

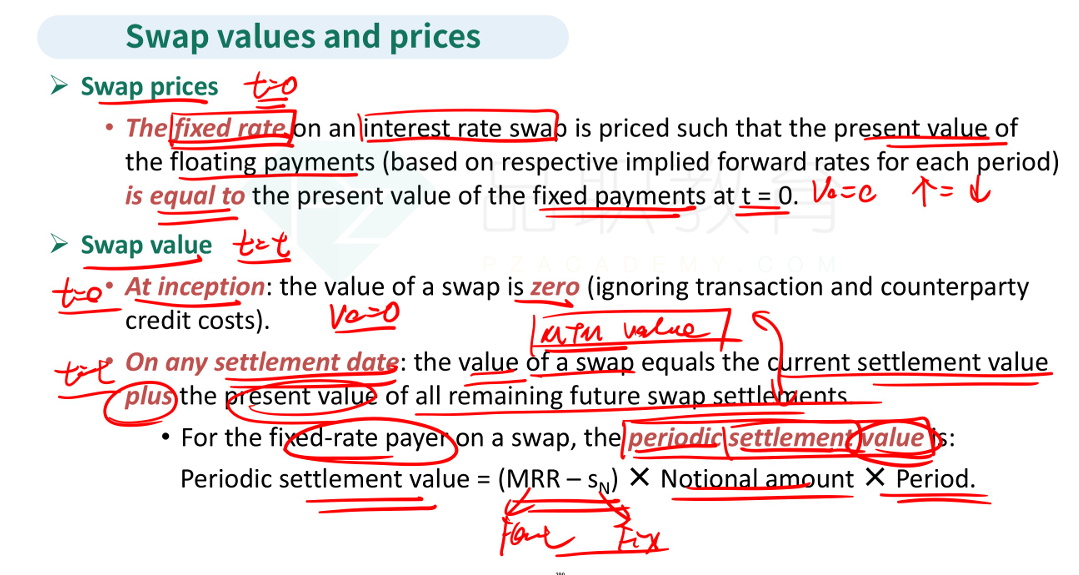

本题考察的是互换在合约期间的value。

互换合约的value由互换两端的利率大小来决定,虽然固定端的利率已知,但是浮动端的利率是随着市场变化而变化的,无法确定下来.

因此我们此时无法判断3个月后,站在QWR的角度上互换的value是正还是负。

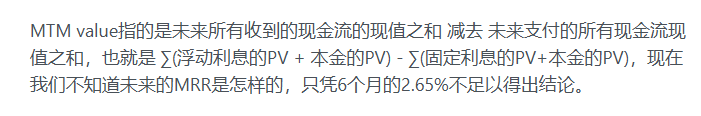

看到有一个答疑的回答中提到MTM value= ∑(浮动利息的PV + 本金的PV) - ∑(固定利息的PV+本金的PV),在讲义中提到的periodic settlement value是用当期的浮动利率和固定利率作差,这个指的是什么value?是做什么用的?

每一次盯市时结算的profit为什么不是这个settlement value,而是往后所有现金流折现后得到的value?

另外关于题干“pays the fixed rate of 3% for the first semiannual period and receives an initial six-month MRR of 2.65%”,这里说的付2.65%收3%,又是在结算什么?

感觉对于swap交易的场景还是不太能想象得出来,所以理解不了题目到底在问什么。