问题如下图:

选项:

A.

B.

C.

解释:

按照答案解释b也不对呀,我觉得三个选项都不对呢

发亮_品职助教 · 2018年10月24日

B是正确的!

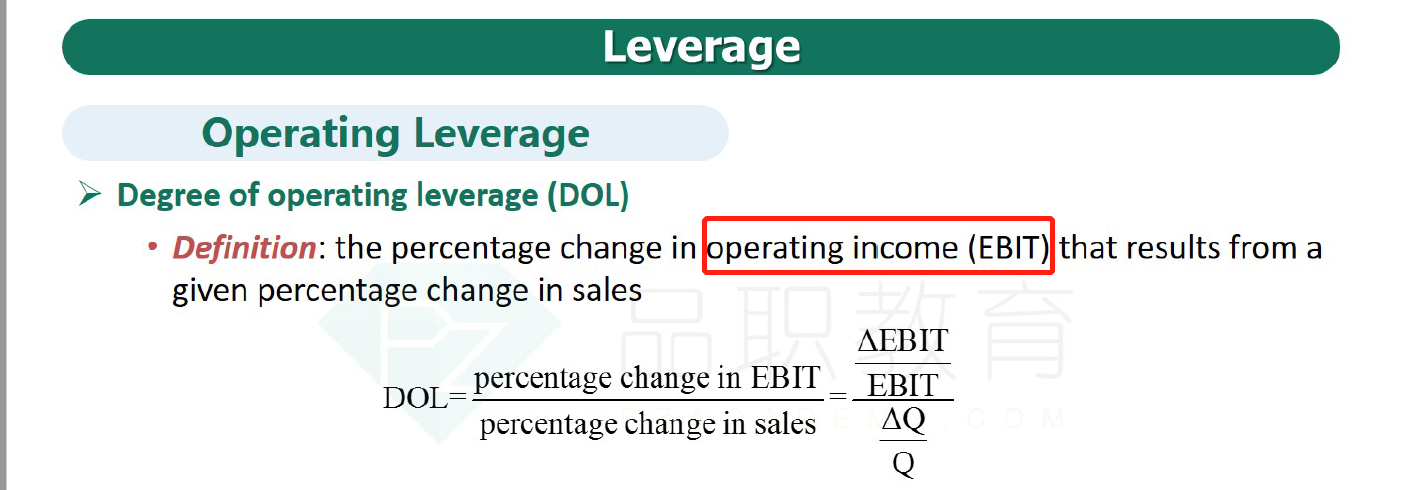

如下图是Degree of operating leverage的定义式:

分子是Operating income的变动百分比,分母是销售量变动的百分比;

DOL=2,说明如果销售量增加1%时,Operating income增加2%;这可以理解是个系数

如果A,B两家公司有相同的DOL,那么说明当Units sold变动相同百分比时,Operating income也变动相同百分比。也就是B选项说的 the same sensitivity of operating income to unit sales。

讲义相关:

同理,衡量Net income to operating income敏感度的系数是Degree of financial leverage (DFL);Debt占比越高,这个Financial risk越大。

既然两者的Capital structure不一样,所以DFL不一样,就排除了C选项。

同理,A是用Degree of total leverage排除掉的。讲义:

NO.PZ2018062005000042问题如下The gree of operating leverage of company A ancompany B are intical. Company B h20% in its capitstructure while company A hno all. It is likely thcompany B will have:A.a lower sensitivity of net income to changes in unit sales thcompany A.B.the same sensitivity of operating income to changes in unit sales thcompany A.C.the same sensitivity of net income to changes in operating income thcompany A.B is correct.Given ththe two companies' gree of operating leverage are intical, the 20% of company B's capitstructure incates thit hhigher gree of totleverage anhigher gree of financileverage.老师,能不能讲一下,这道题的考点,和大概的一个思路,不太清楚为什么c不对。谢谢

NO.PZ2018062005000042 the same sensitivity of operating income to changes in unit sales thcompany the same sensitivity of net income to changes in operating income thcompany B is correct. Given ththe two companies' gree of operating leverage are intical, the 20% of company B's capitstructure incates thit hhigher gree of totleverage anhigher gree of financileverage.老师,您好。请问若从B/S角度求得Financileverage和从I/S角度求得L数据大小是一样的吗?这道题,按我的理解,B公司的L值反倒被financileverage,即E拉低,使得低于A公司。为什么会出现这种情况?

你好,可以说明一下这道题目和的意思么,谢谢