NO.PZ2024050101000057

问题如下:

Banko, Inc., entered into a $10 million notional, 7-year CDS as a protection buyer three years ago at a spread of 1.85%. The current 4-year CDS spread for the same reference entity is 2.30% based on the PV of expected payoff of 0.0312 per $1 notional. The value of the CDS to Banko, Inc., is closest to:

选项:

A.

−$55,000

B.

−$60,900

C.

+$61,000

D.

+$53,000

解释:

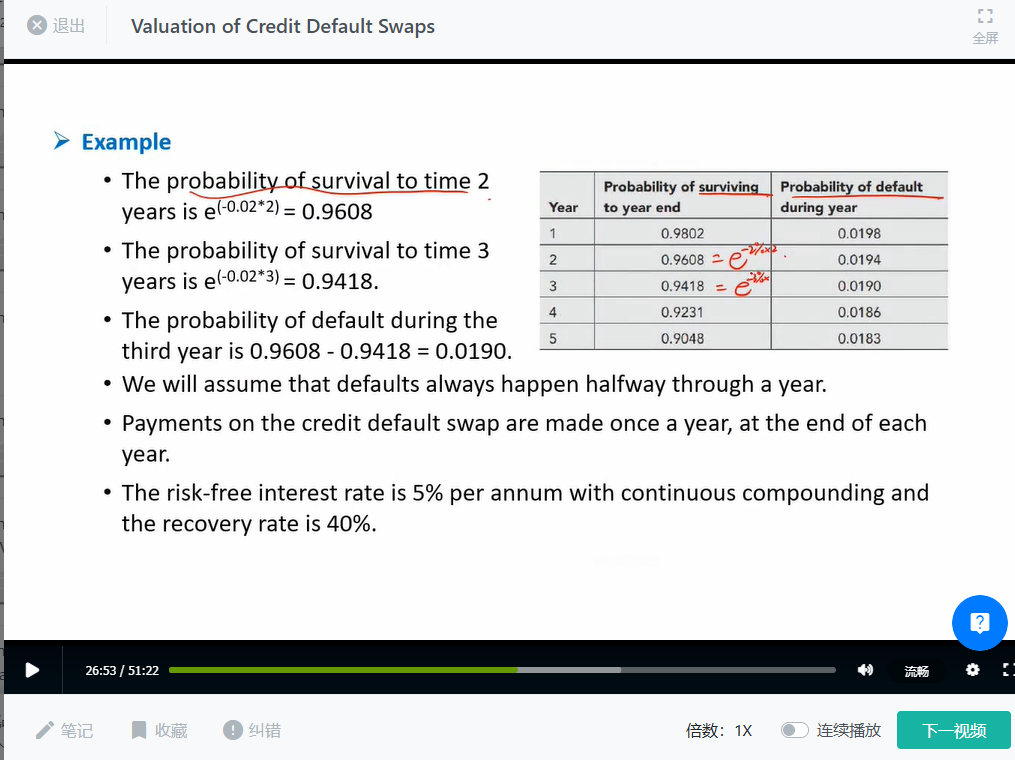

Recognize that the value of the CDS is calculated such that:

Current PV of expected payment = current PV of expected payoff = 0.0312

Using the current spread of 2.30%, the current PV of expected payments = s=0.0312/0.023=1.3565

Applying this value to the initial CDS spread of 1.85% yields:

PV of expected payments = 0.0185*1.3565=0.0251

Value to the protection buyer = PV of expected payoff - PV of expected payments = 0.0312 - 0.0251 = 0.0061 per 1$ notional.

The swap value for the $10 million notional = 0.0061 × 10,000,000 = $61,000. Because the spread has widened, the protection buyer gains.

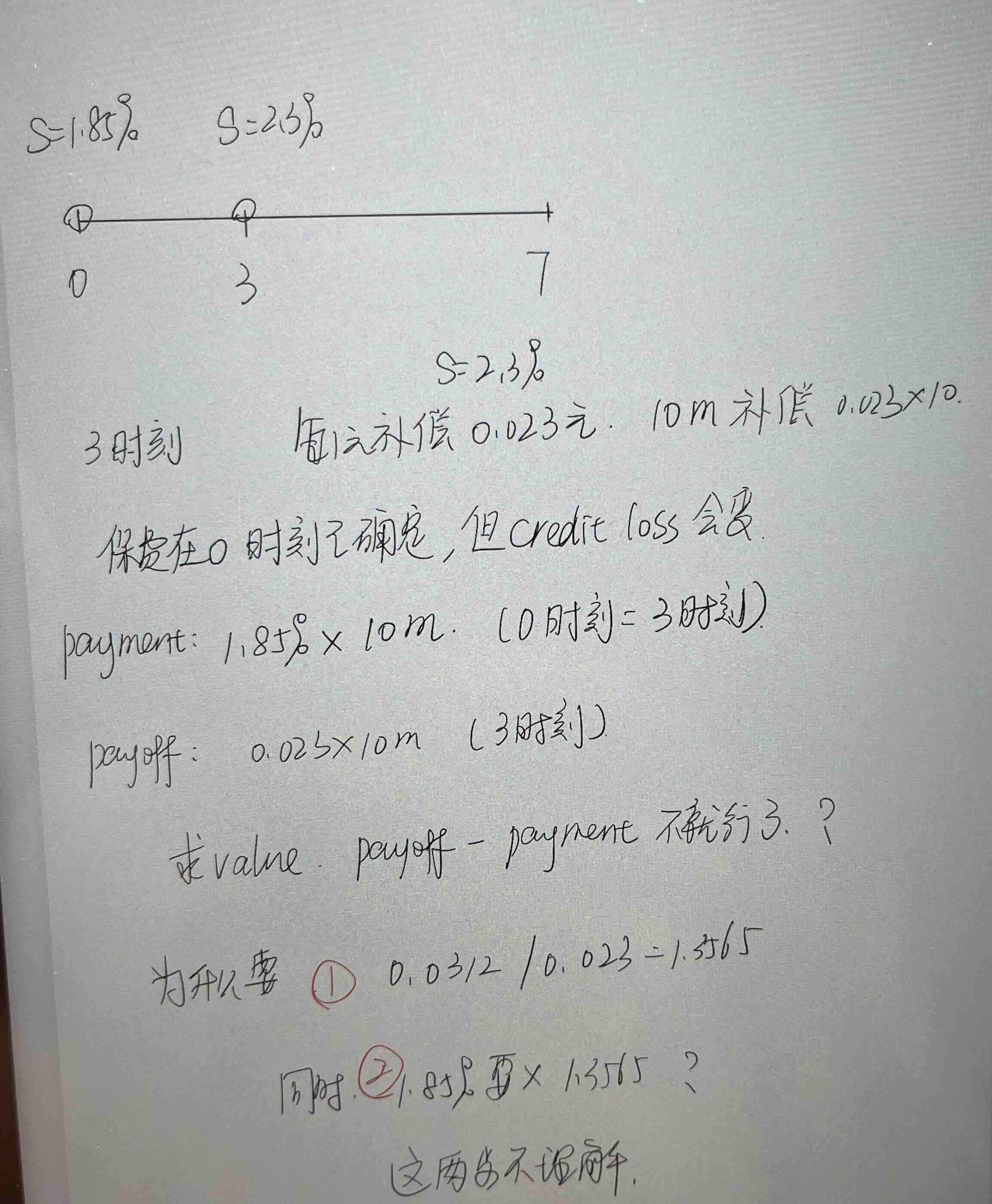

老师好,看了您回答其他同学的答案,还是不太明白“使用当前利差计算预期支付现值:

- 当前利差为2.30%。

- 计算比例 s: s=0.0312/0.023=1.3565

- 这个比率1.3565用来将支付流的现值按当前利差折现为参考实体当前信用状况的现值。

将初始CDS利差应用于该比例:

- 初始CDS利差为1.85%。

- 预期支付现值为: PV of expected payments=0.0185×1.3565=0.0251”

哪里想的不多呢?