NO.PZ2024050101000103

问题如下:

A senior risk analyst at VLT Bank (VLTB), a Singapore-based bank, is analyzing the risks arising from a significant appreciation of the SGD against all other major world currencies. VLTB has the following balance sheet structure:

• Assets:

Ÿ Germany government bonds denominated in EUR

Ÿ Singapore government bonds denominated in SGD

Ÿ Corporate bonds denominated in EUR

Ÿ Commercial loans denominated in SGD

• Liabilities:

Ÿ Long-term senior bonds denominated in EUR

Ÿ Long-term senior bonds denominated in SGD

Ÿ Retail deposits denominated in SGD

Ÿ Corporate term deposits denominated in SGD

The analyst considers other recent market developments, including a decline in global equity prices, which resulted in many of VLTB’s larger retail depositors experiencing margin calls and drawing down deposits to meet them. The analyst notes that the bank took advantage of the demand for fixed-income securities and issued additional long-term senior SGD bonds and the proceed was used to purchase additional Germany government bonds. The overall impact of these transactions on VLTB is that the bank’s net cash outflows during the month, its overall net liabilities flow, and the required amount of stable funding, remain unchanged. The following additional information is provided:

• The available stable funding (ASF) factor for retail deposits is 95%.

• The ASF factor for long-term senior SGD bonds is 100%.

The analyst also assesses the bank’s exposure to ConSol Corp, a publicly traded Singapore manufacturer that is heavily dependent on locally produced raw materials and generates its revenues primarily in EUR. VLTB is a major holder of ConSol Corp’s EUR-denominated bonds and has taken a long CDS position on the bonds. A German bank is the counterparty to that CDS contract.

In analyzing the impact of the reported developments in the currency, equity, and bond markets on VLTB, which of the following is correct?

选项:

A.VLTB’s CDS position will increase in value

B.VLTB’s net stable funding ratio will decrease

C.VLTB’s right-way risk with the German bank will increase

D.VLTB’s liquidity coverage ratio will decrease

解释:

A is correct. ConSol Corp’s currency risk has increased (due to appreciation of SGD against major currencies, ConSol Corp is reliant on EUR revenue), has EUR debt payments due, which most likely increases ConSol Corp’s CDS spread. Thus, the value of the CDS from the perspective of ConSol Corp will increase.

B is incorrect. The shift in the demand deposit base from retail deposits (with available stable funding (ASF) factor of 95%) to long-term senior bonds (with ASF factor of 100%) would lead to a higher available amount of stable funding (numerator of the net stable funding ratio (NSFR) formula) than before, thereby increasing the NSFR. The denominator (the required amount of stable funding) is reported to be unchanged.

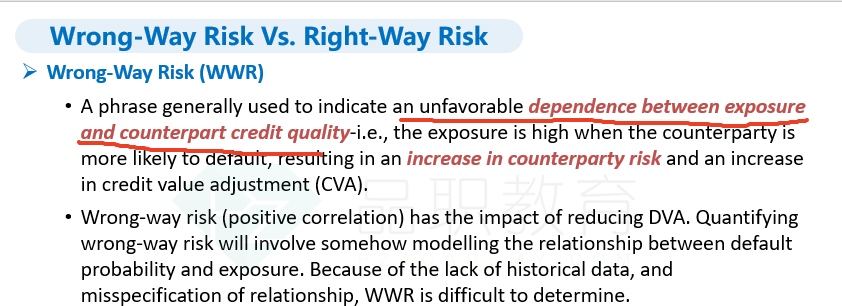

C is incorrect. VLTB has a wrong-way risk (not right-way risk) with the German bank since VLTB’s CDS exposure is increasing (due to ConSol Corp’s condition) as the credit quality of German bank is most likely decreasing (weaker EUR against SGD, and declining equity prices).

D is incorrect. The LCR, defined as HQLA/net CF in 30-day period, will increase since the denominator is unchanged (given) and the numerator increases since additional sovereign securities (Germany government bonds) with no haircuts (compared to lost deposits, with haircuts) have been added.

1、“VLTB是CDS的long方,标的物是ConSol 公司欧元债券,题目一开始就指出,新加坡元是升值的,因此欧元相对新加坡元贬值,所以对于ConSol 这家公司来说,还债压力变大,更有可能违约”,欧元相对新加坡元贬值和ConSol还债情况有什么关系?

2、“跟德国银行的头寸是long CDS, long CDS的一方应该是wrong way risk 才对”,CDS已经确定了,当PD提高,credit loss是增加的,相对已经支付的保费,我的CDS价值应该是下降的,感觉就是right way risk呀?

3、“LCR=HQLA(high quality liquidity asset)/30天的net cash outflow。 根据第二条,当月净现金流出不变,所以分母不变,分析下分子就可以了,没有钱这个VLTB银行买入了德国国债,所以HQLA是上升的才对”德国国债算高质量流动资产?是指流动性较强?