NO.PZ2023020101000026

问题如下:

IST Risk Solutions provides institutional financial risk management

advisory and brokerage services. Clients seek IST’s services when evaluating

whether to hedge interest rate, currency, or equity market risks. Simon Weber,

senior adviser at IST, is discussing a new client with analyst Noel Franco.

Weber states: “Newport State College plans a $10 million

laboratory renovation for its science center and has engaged IST to implement

options strategies in order to manage the risk of rising interest rates. The

renovation is to be completed in 12 months, in time for the start of the school

year. To minimize disruption to its academic schedule, however, Newport will

not begin the work until six months from now. State funding will not be

received until the beginning of the next school year, so a six-month variable

interest rate loan will finance the renovation.”

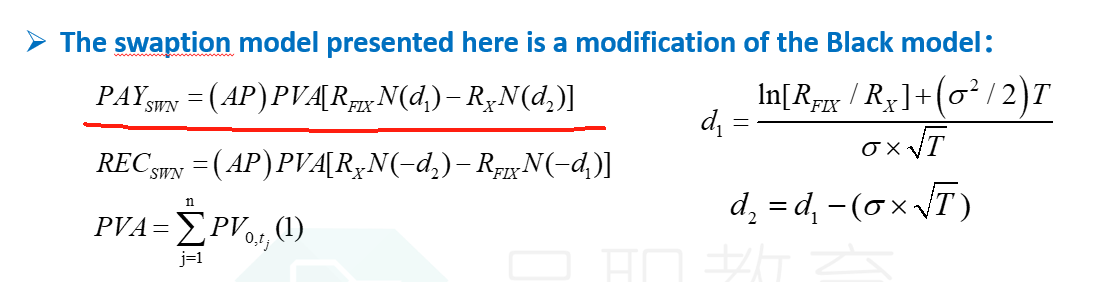

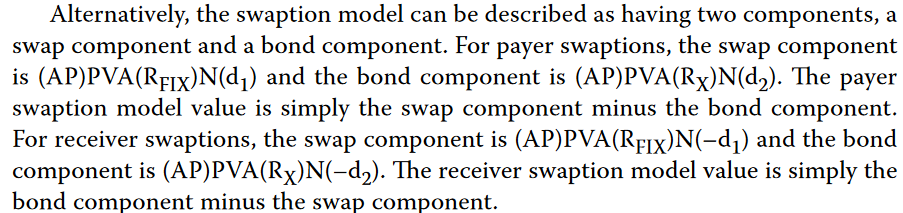

Weber comments: “We can also consider options on swaps,

which the Black model views as having a bond component and a swap component.

The swaption, used to hedge against rising interest rates, can be evaluated as

the swap component minus the bond component.”

Is Weber’s description of the swaption used for the hedge most likely correct?

选项:

A.No, because it

would be correctly evaluated as the bond component minus the swap component

No, because he

is describing a receiver swaption

C.

Yes

解释:

A payer swaption would hedge against rising interest rates. According

to the Black model, the

value of a payer swaption can be described as the swap component minus

the bond component.

B is

incorrect. A receiver swaption hedges against falling interest rates and Weber

is describing a payer swaption.

A is

incorrect. The receiver swaption is evaluated as the bond component minus the

swap component.

A.

No, because it would be correctly evaluated as the bond component minus the swap component。

答案的描述A payer swaption would hedge against rising interest rates. According to the Black model, the

value of a payer swaption can be described as the swap component minus the bond component.

选项F-swap,答案是swap-F,两个不是相反吗?谢谢老师