NO.PZ201512300100000806

问题如下:

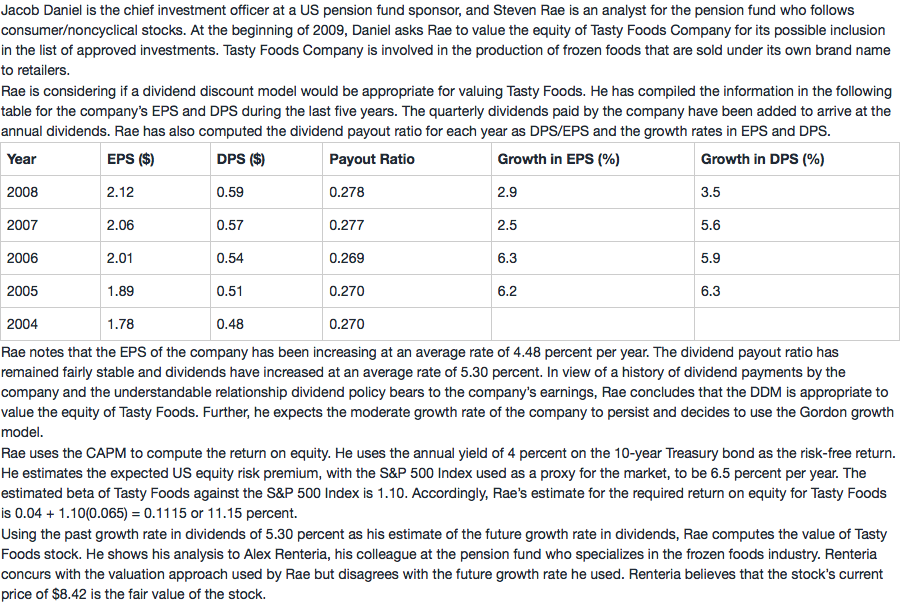

6. If Alex Renteria is correct that the current price of Tasty Foods stock is its fair value, what is expected capital gains yield on the stock?

选项:

A.3.87%.

B.4.25%.

C.5.30%.

解释:

A is correct.

If the stock is fairly priced in the market as per the Gordon growth model, the stock price is expected to increase at g, the expected growth rate in dividends. The implied growth rate in dividends, if price is the fair value, is 3.87 percent. Therefore, the expected capital gains yield is 3.87 percent.

我看懂了公式推导,但我没有太想明白为什么‘’GGM 成立情况下g就是capital gain yield‘’,这个需要掌握吗?

如何理解这件事情呢?