NO.PZ2024030503000013

问题如下:

Question

选项:

A.$7.57. B.$7.69. C.$7.72.解释:

Solution

-

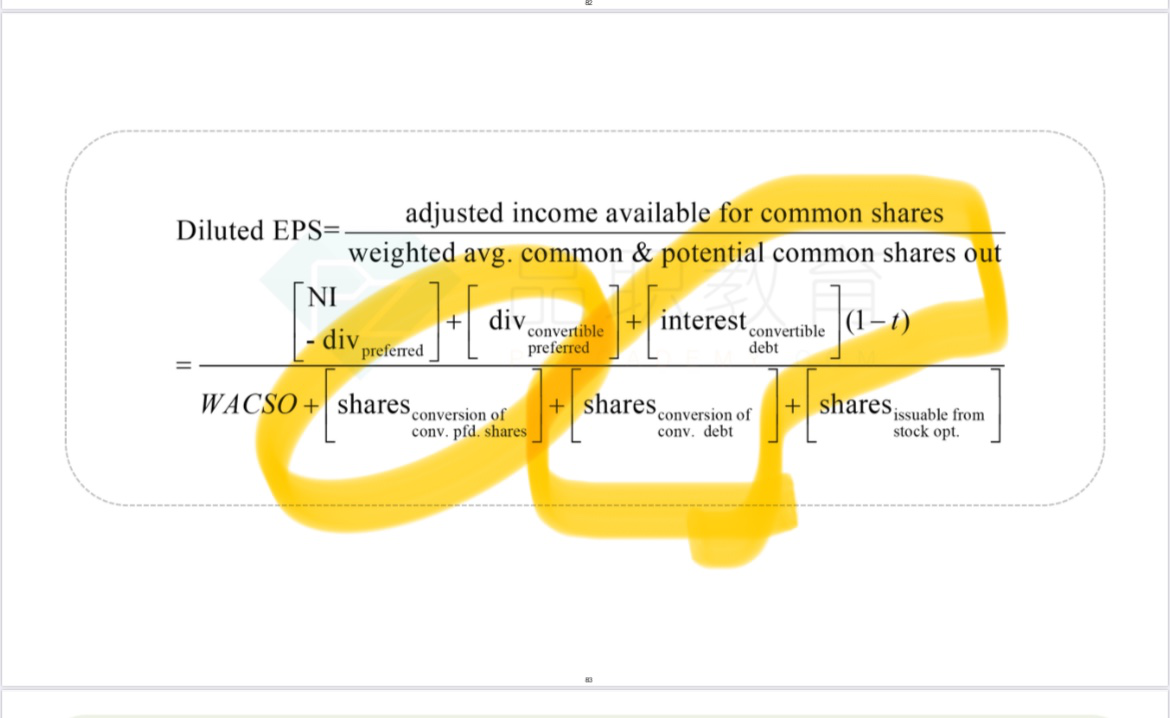

Incorrect. Preferred dividends were included after preferred conversion.

-

Incorrect. After-tax interest on bonds was not added back after bond conversion: after-tax interest is (1 – 0.40) × 8% × $80,000 = 3,840.

-

Correct. Because both the preferred shares and the bonds are dilutive, they should both be converted to calculate the diluted EPS. Diluted EPS is the lowest possible value.

Analyzing Income Statements

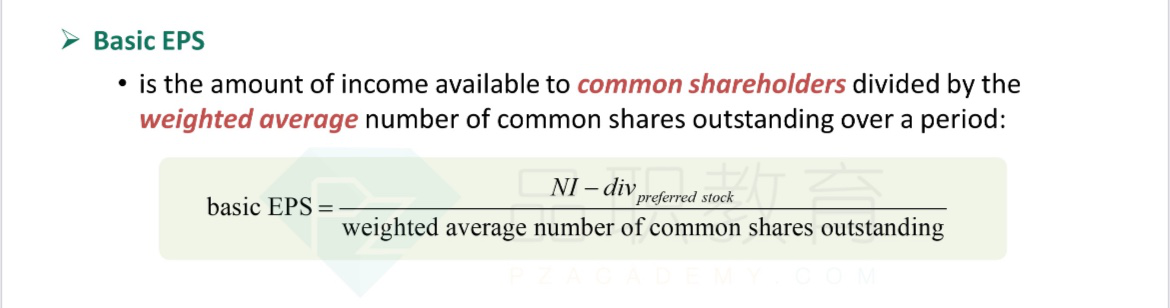

• describe how earnings per share is calculated and calculate and interpret a company’s basic and diluted earnings per share for companies with simple and complex capital structures including those with antidilutive securities

老师这道题麻烦再讲解一下