NO.PZ2024101001000038

问题如下:

Question An analyst gathers the following information about a company's defined benefit pension plan:

If no plan contributions were made during the financial year, the year-end financial statements recognize:

选项:

A.A.an operating expense of £10 million. B.B.an operating cash outflow of £12 million. C.C.other comprehensive income of £14 million.解释:

Solution-

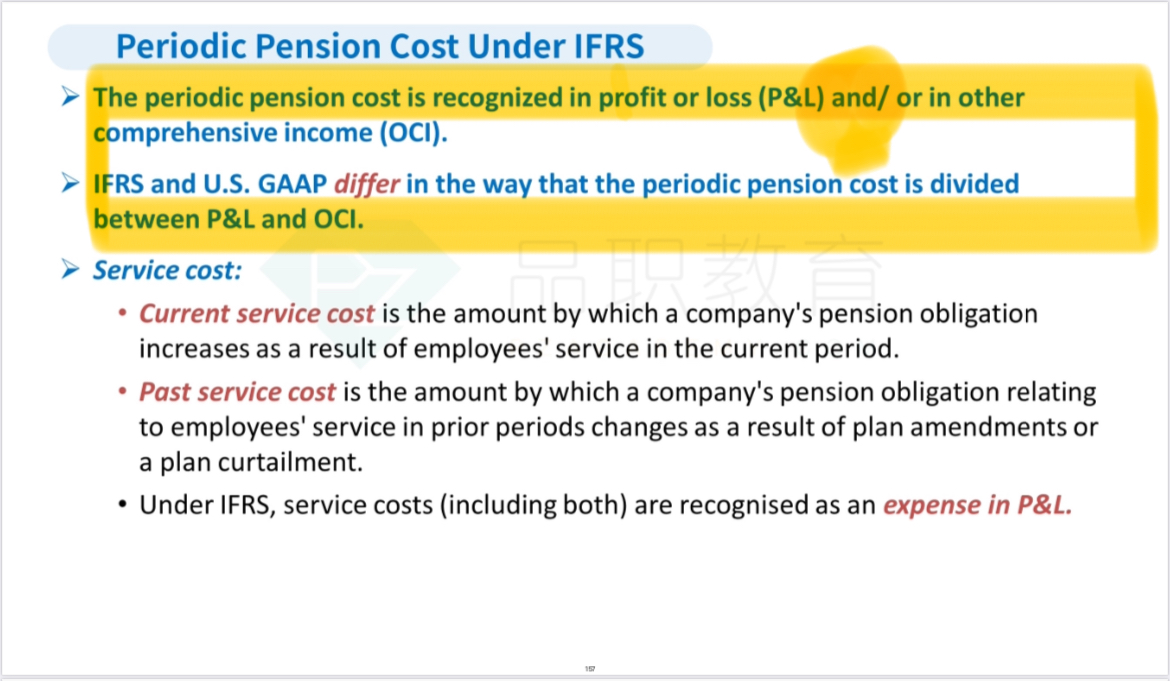

Correct because the pension expense has three components, two recognized on the income statement and one recognized in other comprehensive income (OCI).

1. Service costs, recognized as an operating expense on the income statement

2. Net interest expense/income, calculated by multiplying the net pension liability or net pension asset at the beginning of the period by the discount rate. Net interest expense/income is recognized below the operating income line on the income statement, along with other financing costs like interest cost on debt

3. Remeasurements, recognized in OCI, not in earnings.

Thus, the amount recognized as an operating expense equals the service costs.

Pension expense = Service costs + Net interest expense + Remeasurements

Net interest expense = Net pension liability at the beginning of the period × discount rate = 100 × 5% = 5.

Rearranging, Service costs = Pension expense – Net interest expense – Remeasurements = 12 – 5 – (–3) = 12 – 5 + 3 = 10.

-

Incorrect because this equals the pension expense while out of its three components only service costs are recognized as an operating expense on the income statement. Also, the pension expense, which does not include employer’s contributions to the plan, does not have an impact on cash flow since it is a non-cash accrual based on the change in the net pension liability or asset.

-

Incorrect because it adds the net interest expense and remeasurements from the pension expense, as follows: Pension expense + Net interest expense + Remeasurements = 12 + 5 + (–3) = 12 + 5 – 3 = 14 while only remeasurements are recognized as other comprehensive income.

- explain how post-employment benefits affect the financial statements

Remeasurements应该记录在OCI中,为什么会影响opreating cost?