NO.PZ2024021803000038

问题如下:

For identical assets and maturities, when are long futures contracts typically favored over long forwards?选项:

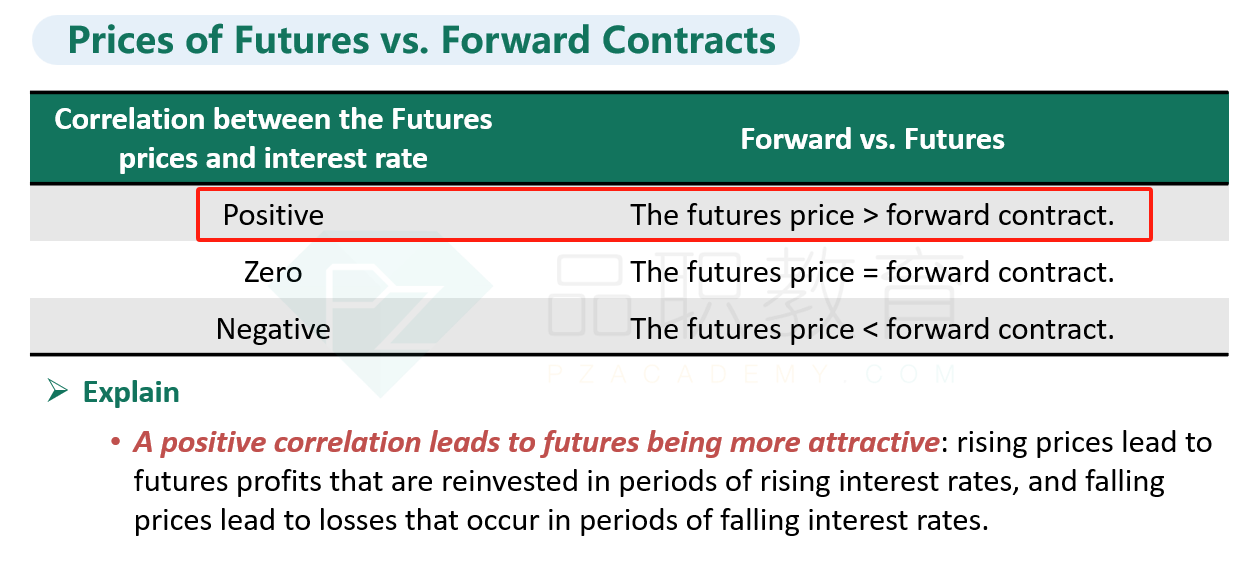

A.With negative correlation between futures prices and interest rates B.With no correlation between futures prices and interest rates C.With positive correlation between futures prices and interest rates解释:

Long futures may be preferred when prices and interest rates are positively correlated, as futures can be adjusted daily for interest rate movements.当futures price和利率正相关时,futures price大于forward contract。麻烦解释一下这道题,以及知识点在哪里,谢谢