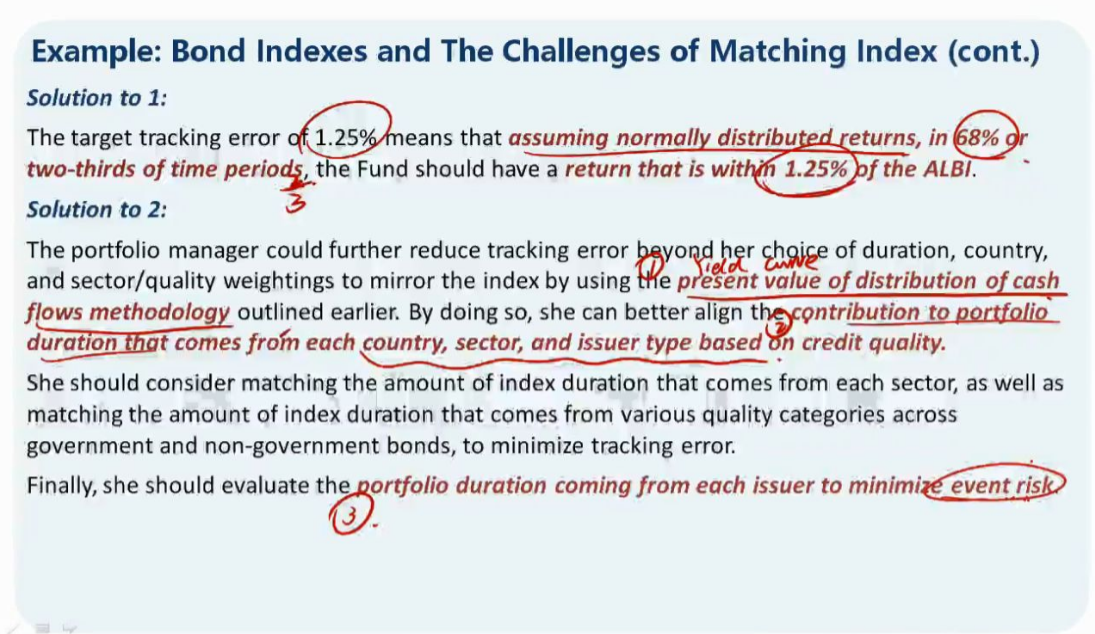

请问老师第二个问题的答案,match the present value of distribution of cash flow methodology 不是用来解决 yield curve risk的吗? 为什么答案说这个办法可以用来align the contribution to portfolio duration that comes from each country, sector, and issuer type based on credit quality???

align the contribution to portfolio duration that comes from each country, sector, and issuer type based on credit quality 不是用来 match option risk的吗? 感觉答案有误啊