NO.PZ2023032703000036

问题如下:

Chaopraya Av is an investment advisor for high-net-worth individuals. One of her clients, Schuylkill Cy, plans to fund her grandson’s college education and considers two options:

Option 1 Contribute a lump sum of $300,000 in 10 years.

Option 2 Contribute four level annual payments of $76,500 starting in 10 years.

The grandson will start college in 10 years. Cy seeks to immunize the contribution today.

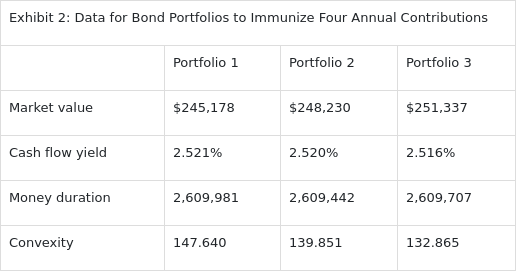

Cy and Av now discuss Option 2. Av estimates the present value of the four future cash flows as $230,372, with a money duration of $2,609,700 and convexity of 135.142. She considers three possible portfolios to immunize the future payments, as presented in Exhibit 2.

Determine the most appropriate immunization portfolio in the Exhibit 2. Justify your decision.

选项:

解释:

Determine the most appropriate immunization portfolio in the Exhibit 2. (circle one)

Portfolio 1 Portfolio 2 Portfolio 3

Justify your response.

Justification:

Portfolio 2 is the most appropriate immunization portfolio because it is the only one that satisfies the following two criteria for immunizing a portfolio of multiple future outflows:

Money Duration: Money durations of all three possible immunizing portfolios match or closely match the money duration of the outflow portfolio. Matching money durations is useful because the market values and cash flow yields of the immunizing portfolio and the outflow portfolio are not necessarily equal.

Convexity: Given that the money duration requirement is met by all three possible immunizing portfolios, the portfolio with the lowest convexity that is above the outflow portfolio’s convexity of 135.142 should be selected.

The dispersion, as measured by convexity, of the immunizing portfolio should be as low as possible subject to being greater than or equal to the dispersion of the outflow portfolio. This will minimize the effect of non-parallel shifts in the yield curve.

Portfolio 3’s convexity of 132.865 is less than the outflow portfolio’s convexity, so Portfolio 3 is not appropriate. Both Portfolio 1 and Portfolio 2 have convexities that exceed the convexity of the outflow portfolio, but Portfolio 2’s convexity of 139.851 is lower than Portfolio 1’s convexity of 147.640. Therefore, Portfolio 2 is the most appropriate immunizing portfolio.

The immunizing portfolio needs to be greater than the convexity (and dispersion) of the outflow portfolio. But, the convexity of the immunizing portfolio should be minimized in order to minimize dispersion and reduce structural risk.

老师,麻烦帮忙看下这样回答能拿满分吗?

Portfolio 2 is the most appropriate.

For best immunization, the portfolio must be 1) Market value must exceed the present value of future cash outflow; 2) Money duration matches; 3) The convexity of portfolio must exceed the future cash flow but the difference should be minimized. As such, portfolio 2 is the most appropriate.