NO.PZ2018062007000030

问题如下:

When interest rates and futures prices are negatively correlated, futures prices will be:

选项:

A.lower than forwards.

B.the same as forwards

C.higher than forwards.

解释:

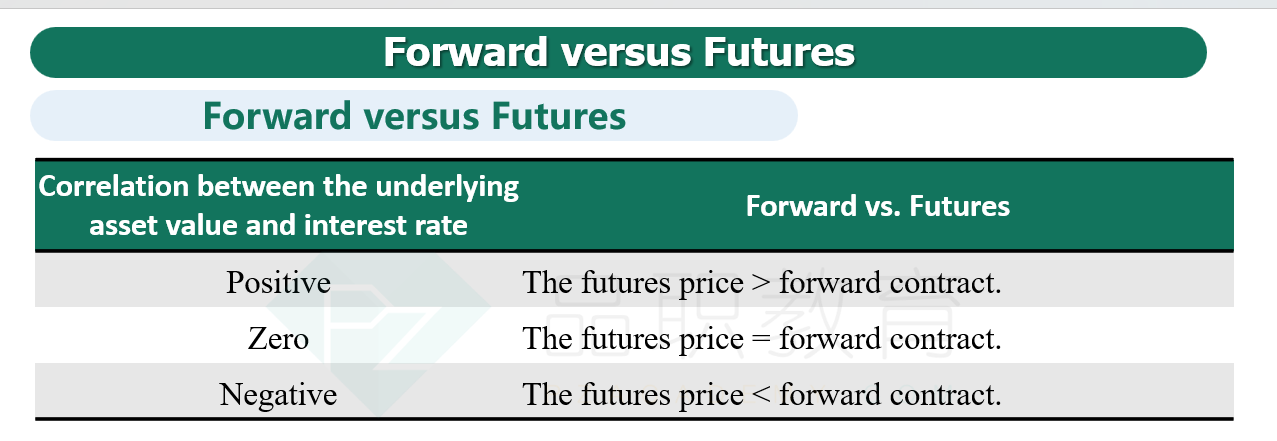

A is correct.

If futures prices and interest rates are negatively correlated, the futures prices increase as interest rates decrease, which lead to long position receives cash earlier and reinvests it at lower rate. Under this situation, investors prefer forward contracts because all profits are received at the end of contract, therefore forward price is higher.

当期货合约价格与利率负相关时,其每日结算出的收益通过再投资获得的收益要小于远期,因而期货价格会略低。

利率不是固定的吗?期货用这样的利率,远期也是同样的利率啊,市场上使用的利率不一样吗?