No.PZ2023032703000048 (问答题)

来源: 经典题

Camille Blanc is a fixed income manager who recently started the Optima mutual fund. The fund is invested in a diversified portfolio of government and corporate bonds. The fund’s mandate requires the effective duration of its portfolio to match that of its benchmark. Blanc’s objective is to outperform a fixed-income benchmark by using an enhanced-indexing strategy.

Blanc evaluates the price sensitivities of Optima relative to its benchmark for changes in the yield curve using scenario analysis:

Scenario 1: She simulates an immediate 10 basis point (bps) parallel shift in the yield curve and finds no difference in the price sensitivities between Optima and its benchmark.

Scenario 2: She simulates an immediate 30 bps change in the 5-year spot rate and holds all other rates constant. She finds a 19 bps difference in the price sensitivities between Optima and its benchmark.

A. Determine whether Optima most likely violates its mandate under each of the following:

i. Scenario 1

ii. Scenario 2

Justify your response for each scenario. (2015 Q3)

Note: Consider each scenario independently.

我的答案:

Scenario 1 didn't violate as there's no price change amid parallel shift in yield curve.

Scenario 2 violates the mandate as under enhanced indexing strategy, all the KRD should be same as the benchmark, meaning when the 5-year spot rate changes and holds all other rate constant, there should not be any difference in price.

参考答案:

i. Optima does not violate its mandate in Scenario 1. Optima and its benchmark exhibit the same price sensitivity to a small parallel shift in the yield curve because Optima is matched on effective duration.

ii. Optima does not violate its mandate in Scenario 2. Optima and its benchmark exhibit different price sensitivities to a non-parallel shift in the yield curve, indicating that Optima is not matched on key rate duration at the 5-year spot rate. However, its mandate does not require that it be matched on key rate duration.

怎么和我的记忆有偏差呢?我记得enhance indexing就是要匹配KRD,其他无所谓。这里意思是“ its mandate does not require that it be matched on key rate duration.”

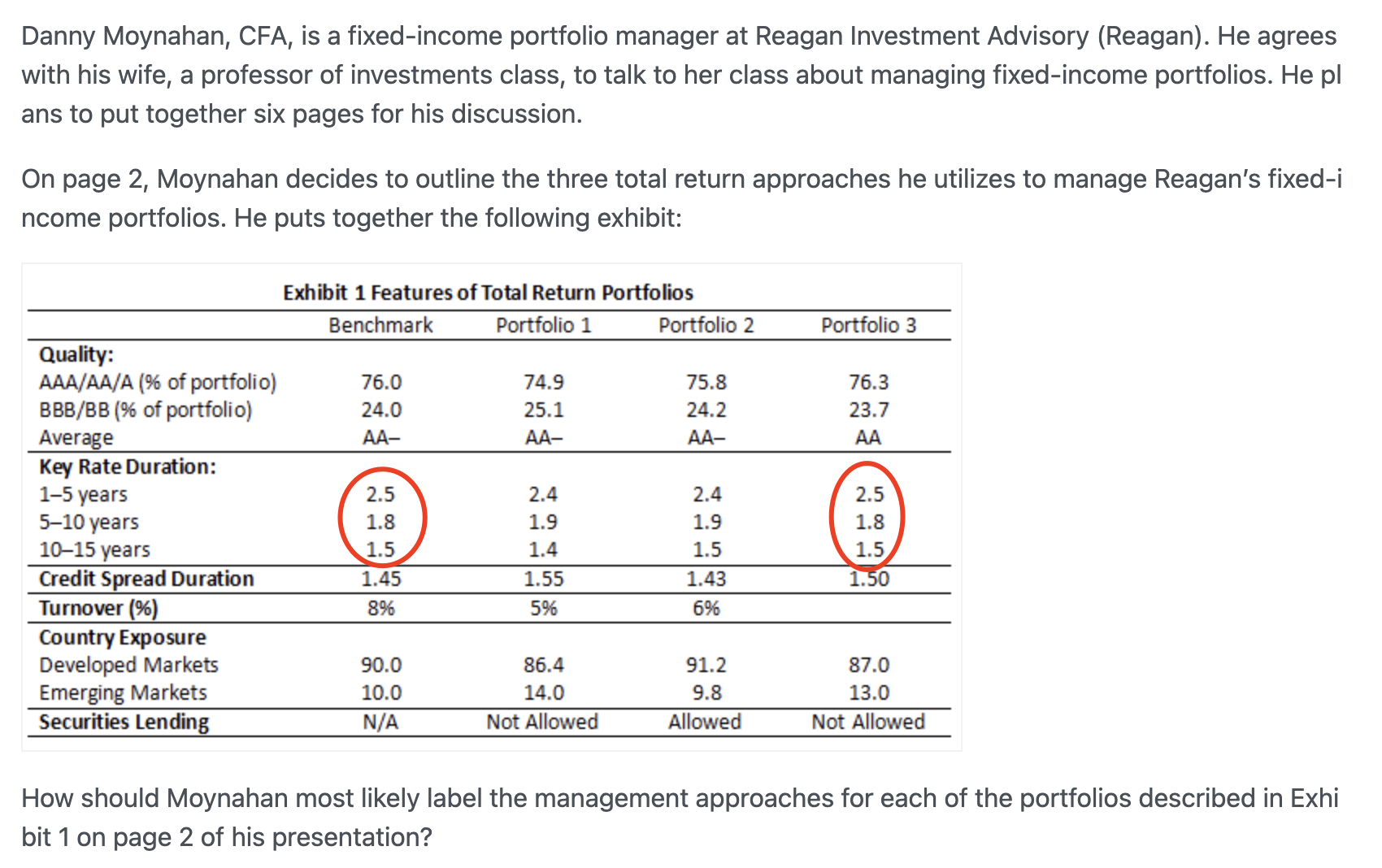

比如下面这道题

这道题要求判断pure index/enhanced index和active,然后下面这段是品职老师的回复:

pure index与enhanced index方法的KRD应该与benchmark完全一致,区别是pure index除了KRD外,其他risk factor如quality、sector、country exposure也应一致,而enhanced index这几个factor不能一致。Active方法的KRD、quality、sector或者country exposure应该与benchmark完全不同。同时,在turnover上,pure indexing<enhanced indexing<active management。

到底哪个有问题?我怎么理解这里