Jason Locke, CFA, has recently been hired as the chief investment officer of the Escarpment Regional Government Employees’ Pension Fund (the Fund). Currently, he is conducting evaluations of all external managers employed by the Fund to ensure that they are providing the highest possible returns for their mandates while complying with all applicable laws and regulations.

Locke is evaluating the activity of Niagara Growth Managers (NGM), a local money manager with an allocation of 10% of the Fund’s assets. He realizes that any reduction in the allocation to this local manager will be met with considerable political pressure. The investment policy statement for NGM’s portion of the Fund’s assets states that NGM is to actively manage an equity portfolio of local small-cap, high-tech companies.

Upon his review of NGM’s activity, Locke is concerned about two items that he would like to have explained. At a meeting with NGM’s portfolio manager, Emma Black, CFA, Locke asks her to comment on each item:

Commodity Positions

- Locke: “Over the last year, several large positions in commodities have been taken by the Fund’s portfolio. This is inconsistent with the IPS.”

- Black: “Commodities have significantly outperformed high-tech equities recently. I added commodities to larger clients’ portfolios on a temporary basis. Clients were not informed, because the positions will be sold once market sentiment shifts. I have not managed commodities before, but I am getting good returns.”

- Locke: “I am uncomfortable with these investments in this portfolio.”

IPO Share Allocation

- Locke: “The Fund’s portfolio received 50,000 shares of an initial public offering on 1 April. On 15 May, 30,000 shares were removed at the current market price.”

- Black: “There was a problem with NGM’s IPO allocation algorithm. Initially, you were overallocated. When we discovered the error, your account was adjusted.”

- Locke: “Short-term interest should have been credited to the Fund for use of its cash to cover the trade. In any case, this was an IPO of a large international high-tech company. It was not an appropriate investment for the portfolio.”

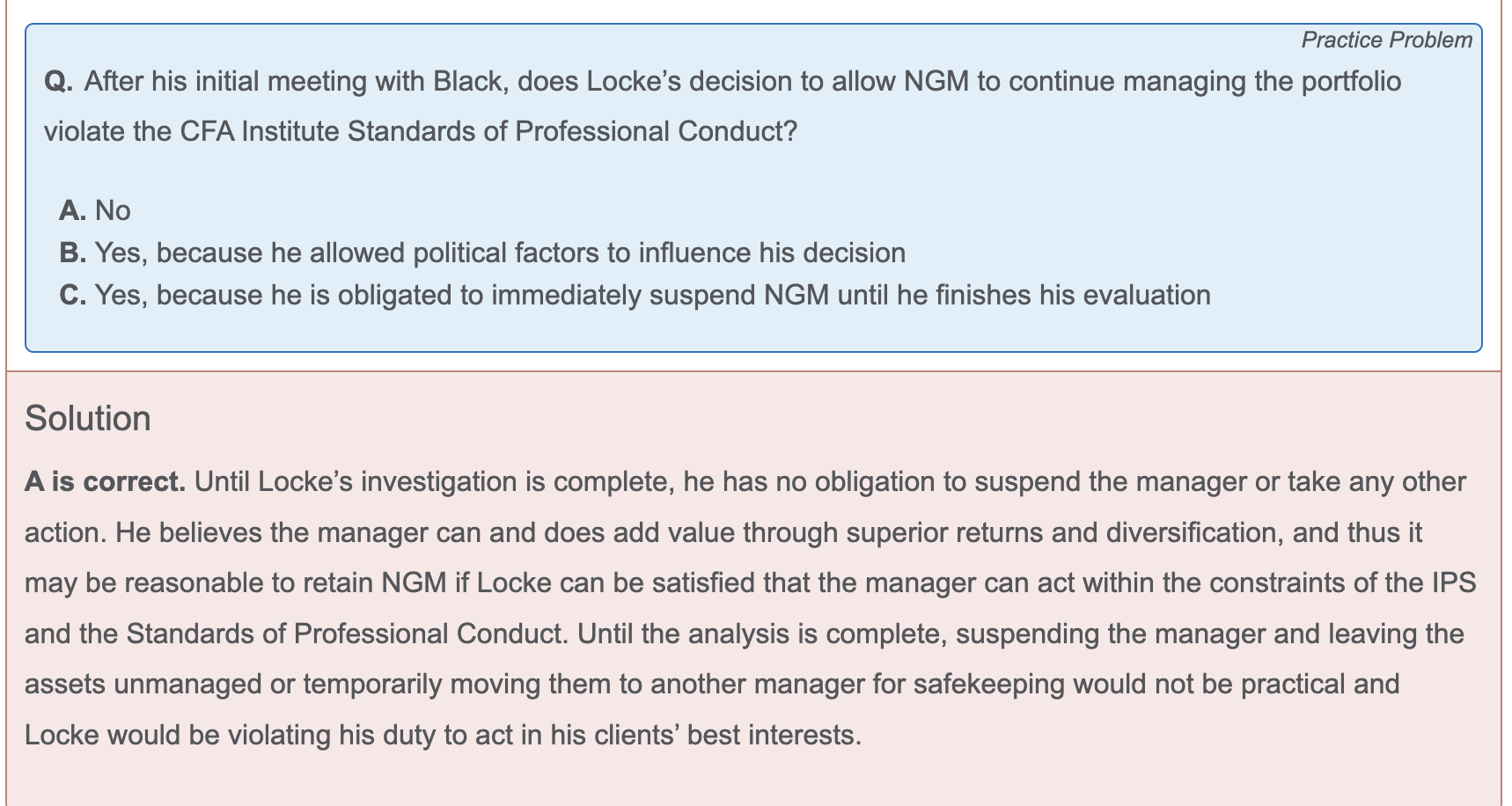

After the meeting, Locke is not satisfied with Black’s comments and decides that further action is required. He also decides that he will allow NGM to continue to manage Fund assets until he finishes his evaluation. This decision is based on the superior returns of the NGM-managed assets, the significant diversification this portfolio adds to the Fund, and the political implications of firing the local money manager.

The next week, Locke calls Black and outlines several conditions that must be fulfilled for NGM to continue as a manager for the Fund. One of the conditions outlined relates to trade allocation.

Trade Allocation

- Locke: “Provide written trade allocation procedures consistent with the CFA Institute Standards of Professional Conduct.”

- Black: “I will mail you a copy of our new procedures stating that trade allocations must be reviewed at the end of each month against the client’s IPS. They also say that interest will be credited to accounts that have been incorrectly allocated shares and debited from those accounts that should have received shares.”

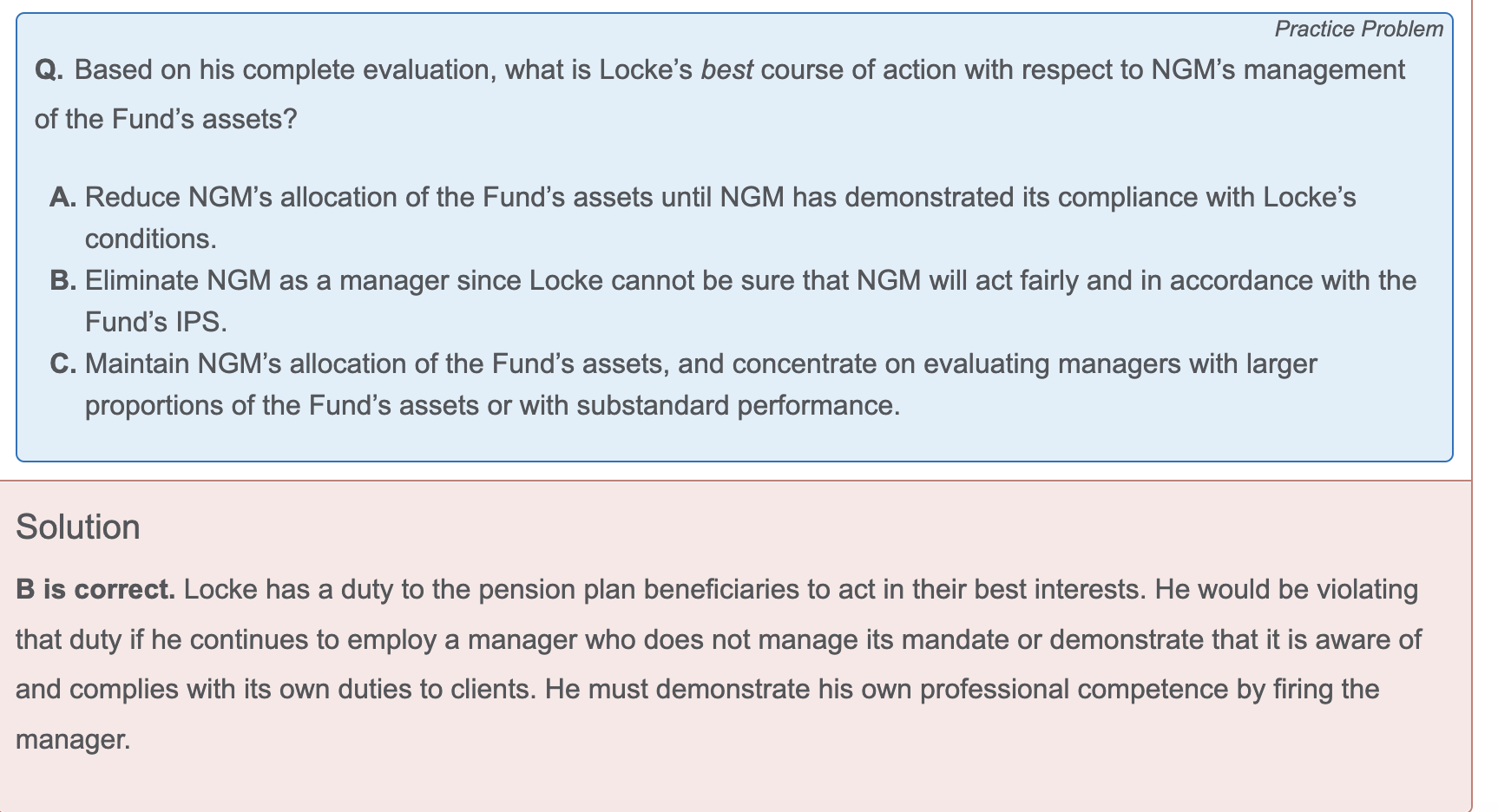

With his evaluation complete, Locke must now consider whether to retain NGM as one of the Fund’s asset managers.

Question

这两题结合在一起看,还是挺别扭的。

最终的结论是要清仓,因为还在违反ethics,之前不清仓不违反是因为还在调查中(哪怕题目明确提及了考虑到政治压力,也不算违反独立客观性),因为之前是在调查中,现在是调查结束了。

是这么理解么?这也太难了 要构建整个框架去理解每个题目的场景