M4 Practice Problems 7-9

Sharfepto Zik, a private wealth manager, is meeting with a 60-year-old client, Edmundo Patel, in order to create an IPS for Patel’s upcoming retirement in the next year. Patel estimates that he will require EUR200,000 per year, with annual increases for inflation, during retirement. Patel’s primary spending goals during retirement are to provide for his family’s needs and maintain his retirement lifestyle. His secondary goals are to fund his philanthropic activities and leave a significant inheritance to his children.

During his retirement, Patel will receive union pension payments of EUR50,000 per year with annual increases for inflation. In his spare time, Patel runs a small business that provides him with an annual income of EUR120,000 and is valued at EUR1 million. He will continue running his business during retirement.

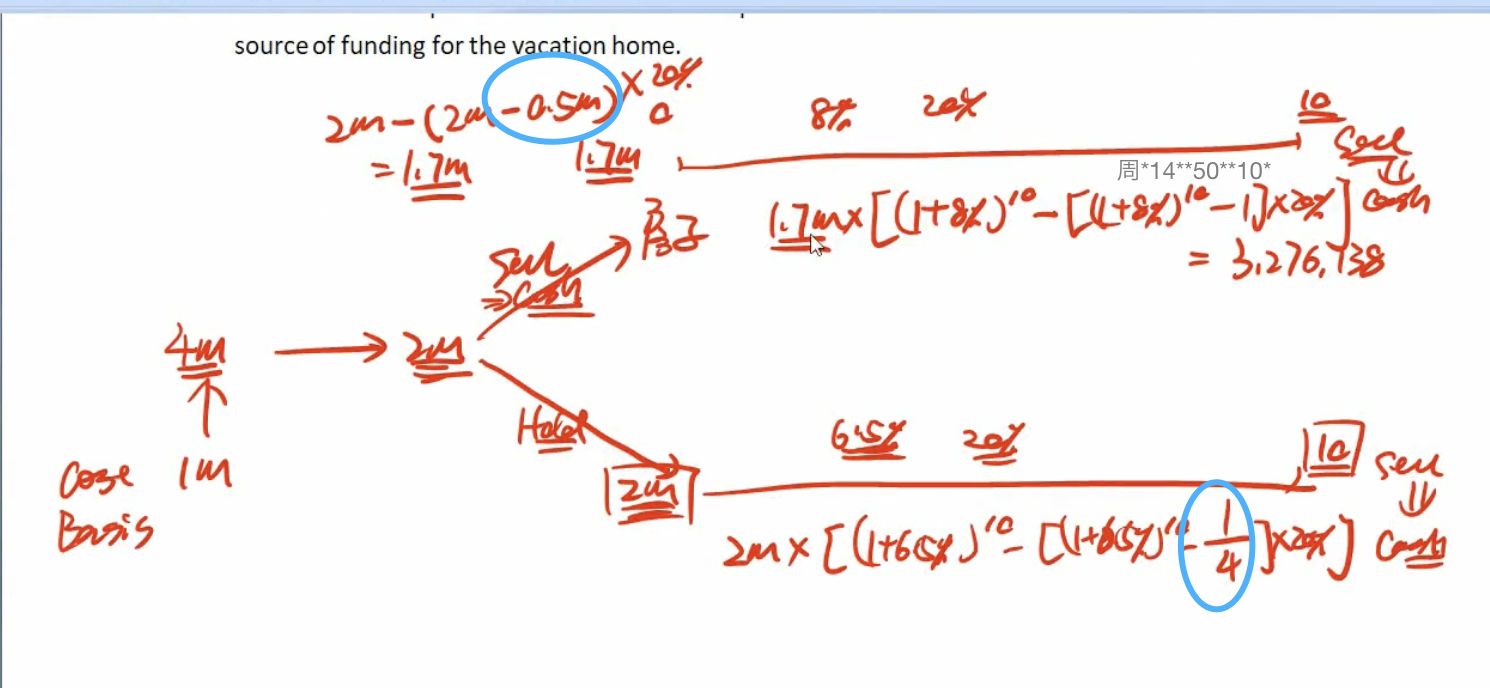

Patel holds a portfolio of securities valued at approximately EUR4 million with a cost basis of EUR1 million. Patel expects an annual pretax capital gains return of 6.5% per year on his securities portfolio. The capital gains tax rate is 20%. The portfolio primarily contains dividend-paying stocks and interest-bearing bonds, and the yield on the portfolio is 2%. Both stock dividend and bond interest are taxed annually at a rate of 40%. In the past, Patel has reinvested all these distributions back into his portfolio but anticipates that after retirement he may need to use some of the distributions to fund his expenses.

Additionally, Patel plans to buy a vacation home to enjoy his early retirement years and expects to hold the home for 10 years. His budget for the vacation home is approximately EUR1.7 million. He expects an 8% annual pretax appreciation in the value of his vacation home and expects to pay capital gains tax of 20% on the sale of this vacation home. Patel is considering selling half of his securities portfolio to fund the vacation home purchase.

Patel is also worried about the effects of inflation. While his pension income will adjust for inflation, he is concerned that the income from his small business is unlikely to adjust with inflation. He asks Zik to do an analysis to assess whether his income sources are expected to be sufficient in 10 years to cover the effects of inflation of 5% per year.

Question

Determine whether Patel should sell half of his securities portfolio to buy the vacation home.

为什么卖掉一半股票去投资房子,cost basis就是0.5m,但是留在组合里以2m进行投资cost basis就是1/4变成0.25m了啊?