NO.PZ2018062004000106

问题如下:

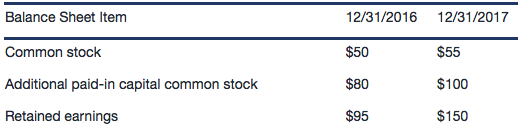

Company A reported net income of $56 million. Based upon the following balance sheets (in $millions),what's the amount of net financing cash flows in 2017? Assume dividends paid are classified as CFF.

选项:

A.

$24 million.

B.

$25 million.

C.

$26 million.

解释:

A is correct. CFF inflow=(55-50)+(100-80)=25

REB+NI-Div paid=REE,95+56-Div paid=150, Div paid=1

Net CFF=25-1=24

如题目 跟Δcommon stock的区别是?