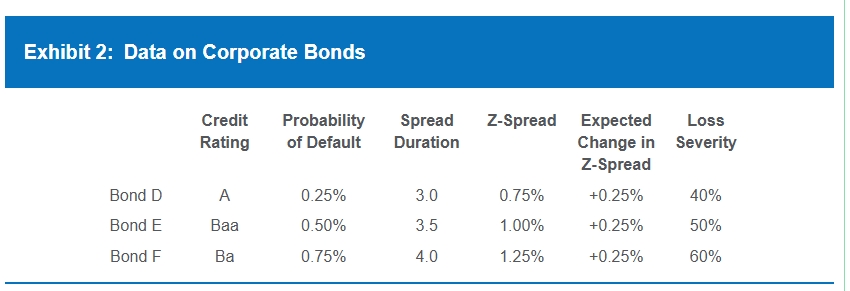

McDown expresses concern about the timing of the credit cycle as it relates to constructing a corporate bond portfolio for CCHC. Larent explains that she uses a bottom-up approach to determine which corporate bonds offer the best relative value should the credit cycle deteriorate. Larent then provides the data in Exhibit 2 for three corporate bonds in which the holding period is assumed to be one year.

The bond in Exhibit 2 with the best relative value is most likely:

- A.

- Bond D.

- B.

- Bond E.

- C.

- Bond F.

Solution

- Correct. Bond D has the best relative value; its expected excess return (EXR) has the smallest loss given the expectation that credit spreads are going to widen by 25 bps (the change in the Z-spread). The expected excess return calculation is as follows:

- EXR = (s × t) – (∆s × SD) – (t × p × L)where

- s = Z-spread

- t = Holding period

- SD = Spread duration

- p = Probability of default

- L = Loss severity

我想问一下这个题目从从哪里判断出要计算EXR的?是看到relative value、bottom up这些字眼就要联想到计算EXR去比较吗?

我做的时候看到 credit cycle deteriorate就直接选择了A也是对的,我得逻辑是信用周期恶化时候long IG short HY