NO.PZ202207040100000301

问题如下:

Grasmere Asset Management Case Scenario

Morgan Abernathy, Nathaniel Granville, and Gabriella Carlucci are analysts at Grasmere Asset Management (Grasmere), an investment firm that offers a diversified mix of actively managed equity and fixed-income investment funds. The firm follows the fundamental approach, using both bottom-up and top-down investment management strategies. The analysts meet regularly to discuss investment ideas and related topics.

The meeting begins with a discussion of the fundamental approach to active equity management strategies. The analysts make the following statements:

The approach is a subjective investment process that uses discretion in making decisions.

The portfolio manager’s selections are based on determining a security’s exposure to selected variables that predict its return.

The construction of a portfolio is generally done using a portfolio optimizer, which controls risk at the portfolio level.

The analysts then review Exhibit 1, which describes a selection of the Grasmere equity funds.

Exhibit 1

Grasmere Equity Funds

The analysts made the following points about the potential investments that Fund B might undertake. The fund should be interested in

investing in the shares of a potential acquirer, even in a consolidating industry;

taking a control position in a distressed company’s shares selling at a deep discount to its intrinsic value; and

using its expertise to make long-term investments involving companies in reorganization.

Grasmere’s larger funds have had an impressive long-term record compared with peers. In more recent times, however, the results have been lagging. Positions have become more concentrated than in the past, and the proportion of positions underperforming their respective industries has increased. Carlucci believes managers may have become subject to two biases: an illusion of control and confirmation bias. Carlucci asks Abernathy what steps he could recommend to address the effect of these biases.

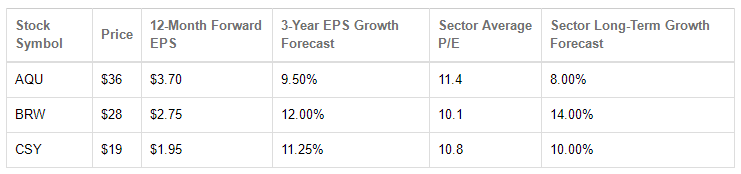

The final topic involves a discussion of some high-profile companies that recently released their full-year earnings results. Exhibit 2 contains market data and financial projections on three of the stocks discussed by Grasmere’s analysts. They are considering adding one of these stocks to Fund D.

Exhibit 2

Market Data and Financial Projections of Selected Stocks

Question

Based on the descriptions in Exhibit 1, which fund is least likely to use a combination of a top-down and a bottom-up strategy?

选项:

A.Fund A B.Fund B C.Fund C解释:

SolutionB is correct. Fund B uses only a bottom-up approach. Searching news sources is used only to identify target companies that are then analyzed by the firm’s analysts.

A is incorrect. Fund A uses a combination of the bottom-up and top-down approaches. The selection of stocks based on company analysis is a bottom-up approach, whereas the use of overlays to control risk is a top-down approach.

C is incorrect. Fund C uses a combination of the top-down and bottom-up approaches. The fund invests globally on the basis of country and sector parameters set by the investment strategist, which is a top-down approach. The subsequent selection of stocks by the portfolio manager based on judgement and experience is a bottom-up approach.

采用主观的判断和经验不是属于基本面分析和量化之间的区别,怎么成了判断自上而下或者自下而上的分析方法?