NO.PZ2023040501000169

问题如下:

Sallie Kwan Industrials (SKI) reports under US GAAP. The company

disclosed the following information in a note to its financial statements

titled “Share-Based Compensation.”

Under our Share Incentive Plan, the Company grants

restricted stock units (“RSUs”) to its officers, employees, directors and other

eligible persons of up to 83,000,000 Class A ordinary shares. RSUs vest 25% on

the first anniversary year from the grant date and the remaining 75% vest in 12

substantially equal quarterly installments. RSU activity for the two years

ended 31 December 20X2 was as follows.

Share-based

compensation expense for RSUs is measured based on the fair value of the

Company’s ordinary shares on the date of grant. SKI accounts for forfeitures as

they occur.

The amount recognized as operating expense on SKI’s income

statement related to its Equity Incentive Plan for the year ended 31 December

20X2 is closest to:

选项:

A.SGD 51.4 million

SGD 64.1 million.

SGD 123.1 million.

解释:

A is correct. The amount recognized as operating expense is

the share-based compensation expense, which the product of 3,332,063 RSUs

vested with a per-share grant-date fair value of SGD 19.25 less forfeitures of

442,181 with a per-share grant-date fair value of SGD 28.74. (3,332,063 x

19.25) – (442,181 x28.74) = 51,433,931.

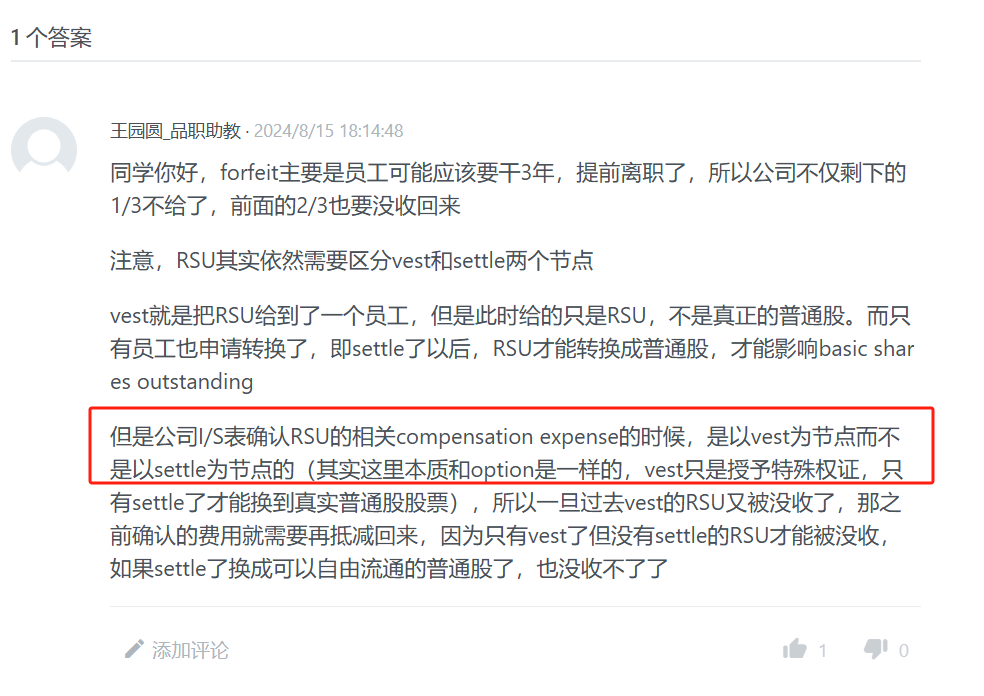

老师您好,您之前的解答很清楚,我就是想加深一下理解,和您确认两个问题:

1)RSU中的Vest和Settle实际上也是有先后的,会计处理是不是如下:首先是Vest RSU,即借方:SBC Expense,贷方: SBC Reserve。但是,Settle RSU后,才能转股成为普通股,即借方:SBC Reserve,贷方:Common Stock。

2)RSU中,如果SBC Expense的变动是受到Vest和Forfeit两个科目的影响,那是不是settle相关的信息对SBC Expense并没有影响,因为Settle只影响普通股股数?或者我可不可以就用这个公式来解释:当期Net SBC Expense=当期Vested Value-当期Forfeited Value。

谢谢老师,问的方向有点偏还请包含