NO.PZ202303150300000406

问题如下:

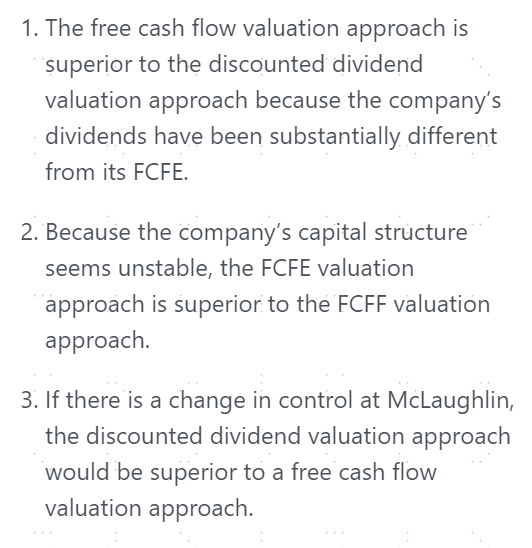

Which of Nicosia’s three statements pertaining to McLaughlin’s valuation is the most accurate? Statement:选项:

A.2 B.3 C.1解释:

SolutionC is correct. Nicosia’s first statement is correct. Analysts should use a FCFE valuation whenever dividends differ significantly from the company’s capacity to pay dividends or when a change of control is anticipated. A FCFF valuation is preferred over a FCFE valuation whenever the capital structure is unstable or ever-changing. So, Nicosia’s first statement is correct, and her second and third statements are incorrect.

A is incorrect. Analysts should use free cash flow to equity valuation whenever dividends differ significantly from the company’s capacity to pay dividends. FCFF valuation is preferred over FCFE valuation whenever the capital structure is unstable or ever-changing.

B is incorrect. With control comes discretion over the uses of free cash flow, as does the capacity to change dividend levels. As such, a free cash flow valuation approach is likely to be superior to a discounted dividend valuation approach.

看课件里,DDM是从shareholders的角度估值的,为什么在change in control的时候不能用DDM?这道题的角度是什么,要怎么理解呀?