NO.PZ2023032701000064

问题如下:

Castovan’s final assignment is to determine the intrinsic value of TTCI using both a singlestage and a multistage RI model. Selected data and assumptions for TTCI are presented in Exhibit 2.

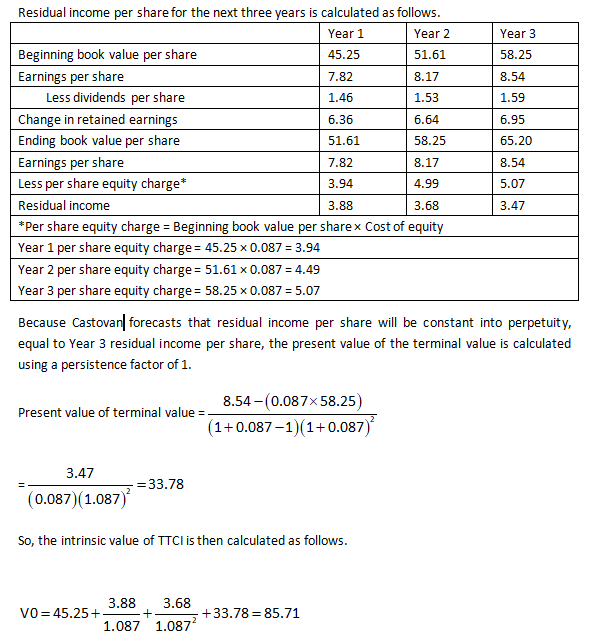

For the multistage model, Castovan forecasts TTCI’s ROE to be higher than its long-term ROE for the first three years. Forecasted earnings per share and dividends per share for TTCI are presented in Exhibit 3. Starting in Year 4, Castovan forecasts TTCI’s ROE to revert to the constant long-term ROE of 12% annually. The terminal value is based on an assumption that residual income per share will be constant from Year 3 into perpetuity.

Beckworth questions Castovan’s assumption regarding the implied persistence factor used in the multistage RI valuation. She tells Castovan that she believes that a persistence factor of 0.10 is appropriate for TTCI.

Based on Exhibits 2 and 3 and the multistage RI model, Castovan should estimate the intrinsic value of TTCI to be closest to:

选项:

A.€54.88

€83.01

€85.71

解释:

PVRIt-1=(RIt-1xω)/(1+r-ω) 为什么不用这个公式折现?