NO.PZ2023040601000146

问题如下:

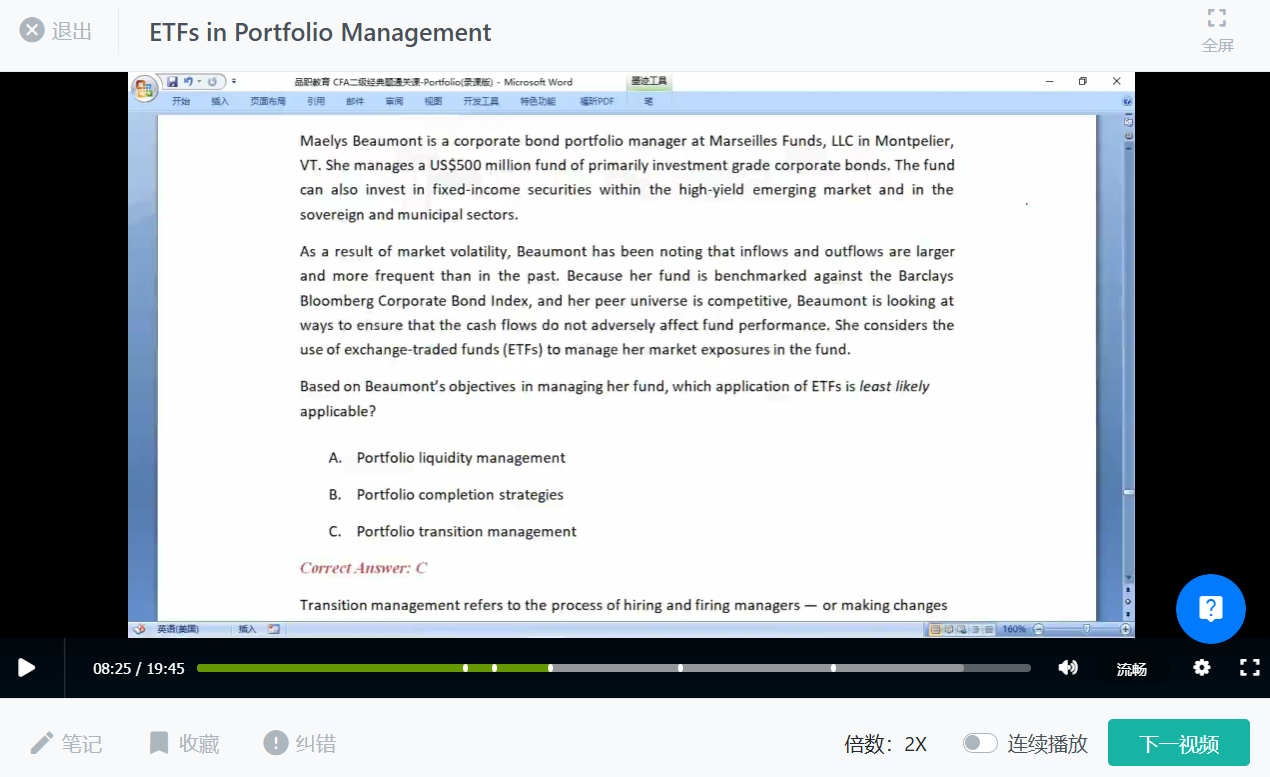

Maelys Beaumont is a corporate bond portfolio manager at Marseilles Funds, LLC in Montpelier, VT. She manages a US$500 million fund of primarily investment grade corporate bonds. The fund can also invest in fixed-income securities within the high-yield emerging market and in the sovereign and municipal sectors.

As a result of market volatility, Beaumont has been noting that inflows and outflows are larger and more frequent than in the past. Because her fund is benchmarked against the Barclays Bloomberg Corporate Bond Index, and her peer universe is competitive, Beaumont is looking at ways to ensure that the cash flows do not adversely affect fund performance. She considers the use of exchange-traded funds (ETFs) to manage her market exposures in the fund.

Based on Beaumont’s objectives in managing her fund, which application of ETFs is least likely applicable?

选项:

A.Portfolio liquidity management

Portfolio completion strategies

Portfolio transition management

解释:

Transition management refers to the process of hiring and firing managers — or making changes to allocations with existing managers. In this application, the manager can add the desired exposure to a market segment with ETFs while shedding exposure to the market segment she has received in kind. Beaumont is experiencing inflows and outflows in her corporate bond fund. An efficient way to maintain the desired exposure is to buy and sell ETFs as flows occur. Using ETFs for portfolio completion can help fill in temporary gaps in exposure while she finds individual bonds to trade. The liquidity of ETFs relative to individual bonds allows Beaumont to quickly invest inflows or meet redemptions.

A is incorrect. Portfolio liquidity management is easily achieved with the use of ETFs.

B is incorrect. Beaumont can use ETFs to invest the outflows or meet redemptions and keep her exposure to the market.

老师可以解释一下这道题的考点和三个选项的解释吗