问题如下:

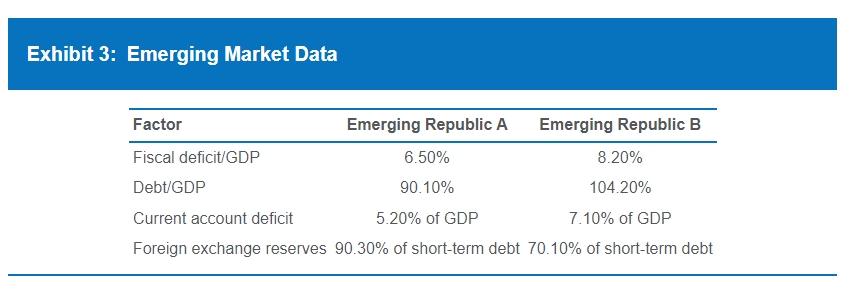

Although the foundation’s fixed-income portfolios have focused primarily on developed markets, the portfolio manager presents data in Exhibit 3 on two emerging markets for Martin to consider. Both economies increased exports of their mineral resources over the last decade.

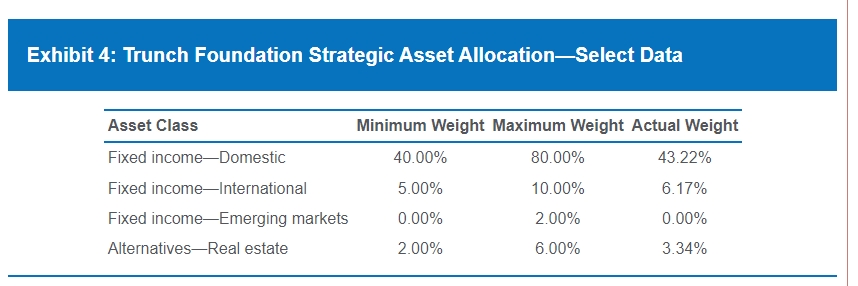

The fixed-income portfolio manager also presents information on a new investment opportunity in an international developed market. The team is considering the bonds of Xdelp, a large energy exploration and production company. Both the domestic and international markets are experiencing synchronized growth in GDP midway between the trough and the peak of the business cycle. The foreign country’s government has displayed a disciplined approach to maintaining stable monetary and fiscal policies and has experienced a rising current account surplus and an appreciating currency. It is expected that with the improvements in free cash flow and earnings, the credit rating of the Xdelp bonds will be upgraded. Martin refers to the foundation’s asset allocation policy in Exhibit 4 before making any changes to either the fixed-income or real estate portfolios.

Based only on Exhibits 3 and 4 and the information provided by the portfolio managers, the action most likely to enhance returns is to:

选项:

A.decrease existing investments in real estate by 2.00%.

B.initiate a commitment to emerging market debt of 1.00%.

C.increase the investments in international market bonds by 1.00%.

解释:

C is correct.

An investment in the bonds of the international energy exploration and production company (Xdelp) looks attractive. The international market benefits from positive macroeconomic fundamentals: point in the business cycle, monetary and fiscal discipline, rising current account surplus, and an appreciating currency. The anticipated credit rating improvement will add to the potential for this to become a profitable investment and enhance returns. An increase in the investments within the international fixed-income segment by 1.00% (existing weight is 6.17%) would take advantage of this opportunity and remain in compliance with the foundation’s 5.00%–10.00% strategic asset allocation limits.

A is incorrect because a decrease in the existing weight of real estate by 2.00% would put the portfolio weight below the minimum threshold of 2.00% (i.e., 3.34% ̶ 2.00% = 1.34%) of the foundation’s strategic asset allocation.

B is incorrect because the information presented in Exhibit 3 would lead the chief investment officer to avoid the two opportunities in emerging market debt (Emerging Republic A and Emerging Republic B) and not initiate a commitment to emerging market debt of 1.00% (i.e., increase the existing weight above 0.00%).

对国际能源勘探和生产公司(Xdelp)债券的投资看起来很有吸引力。国际市场受益于积极的宏观经济基本面:商业周期、货币和财政纪律、不断增长的经常账户盈余,以及货币升值。预期的信用评级改善将增加这一投资的盈利潜力,并提高回报。国际固定收益部门的投资增加1.00%(现有权重为6.17%)将利用这个机会,并保持符合基金会5.00%-10.00%的战略资产配置限制。

A是不正确的,因为房地产现有权重下降2.00%,投资组合权重就会低于基金会战略资产配置的最小阈值2.00%(3.34%-2.00% = 1.34%)。

B是错误的,因为在表3中显示的信息将导致首席投资官避免新兴市场债务的两个机会(新兴共和国A和新兴共和国B),并没有启动对新兴市场债务1.00%的承诺(即增加现有权重超过0.00%)。

解析我能看懂,但是题干中“Both the domestic and international markets are experiencing synchronized growth in GDP midway between the trough and the peak of the business cycle.”这句话如何如何理解?我做的时候以为是考察late expansion (midway between the peak of cycle)资产配置,如果是late expansion的话就不应该配债券,所以我选了B,就是不在domestic和international market投资债券(当然B我选的时候也是知道上一题从债券等方面两个EM都不应该投资),请帮我捋一下思路,谢谢!