NO.PZ2023100703000091

问题如下:

For a 2-year zero-coupon bond, the 1-year rate is expected to remain at 5% for the first year. For the second year, it is foretasted the that 1-year spot rate will be either 7% or 3% at equal probability of 50%. If you are asked to reflect the convexity effect for this 2-year bond by Jensen’s inequality formula, which of the following inequalities is the best Correct Answer?选项:

A.$0.90736 > $0.90703 B.$0.90703 > $0.90000 C.$0.95238 > $0.90736 D.$0.95273 > $0.95238解释:

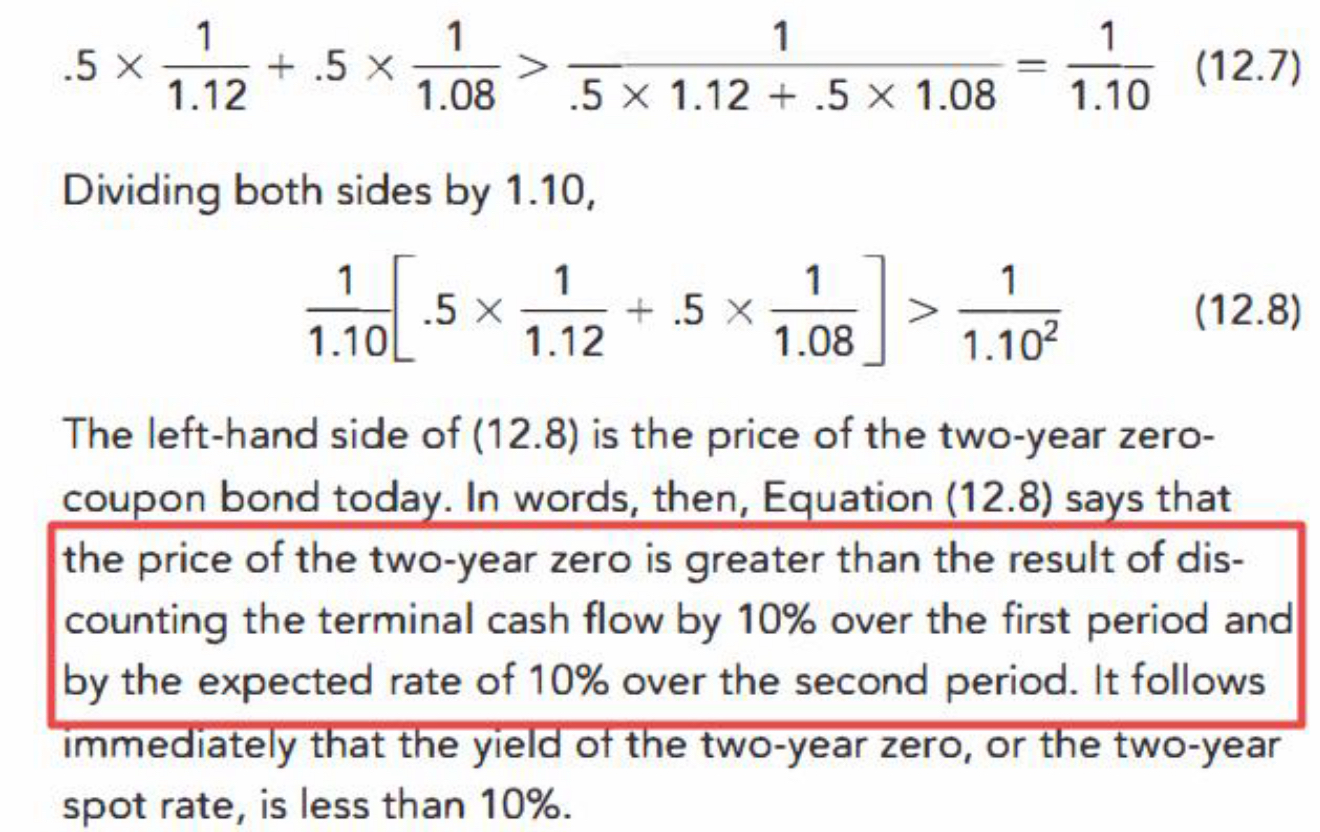

The left-hand side of Jensen’s inequality

0.95273/1.05 = 0.90736

The right-hand side of the inequality:

0.95238/1.05 = 0.90703

我觉得D更直接的展示了这个不等式