NO.PZ2023091701000098

问题如下:

A risk analyst at a pension fund is using the historical simulation approach to calculate the 1-day ES of a portfolio of assets. The analyst begins by generating a set of 250 scenarios for the portfolio. Which of the following assumptions or procedures correctly describes the most appropriate way for the analyst to generate asset values for each of the scenarios used in the historical simulation?

选项:

A.Assume that a group of market variables change as they did during one of the days in a historical reference period, and apply these changes to the current values of these variables, which are then used to calculate asset values.

B.Assume that the values of the assets in the portfolio experience the same percentage change as they did during one of the days in a historical reference period.

C.Assume that a group of market variables has a multivariate normal distribution based on their movements during a historical reference period, and use a sampled value from this distribution to calculate asset values.

D.Assume that the values of the assets in the portfolio have a multivariate normal distribution based on their movements during a historical reference period, and then sample once from this distribution of asset values.

解释:

A is correct. Historical simulation involves identifying market variables (usually termed risk factors) on which the value of the portfolio under consideration depends. Daily data is collected on the behavior of the risk factors over a period in the past. Scenarios are then created by assuming that the change in each risk factor over the next day corresponds to a change observed during one of the days used in the historical simulation.

B is incorrect. Historical simulation entails modeling movements in risk factors as described in A above, and using these to calculate asset values, rather than directly modeling movements in the asset values themselves.

C is incorrect. This is part of the procedure used in Monte Carlo simulation.

D is incorrect. This models asset value movements directly rather than using risk factors, and also partially describes Monte Carlo simulation.

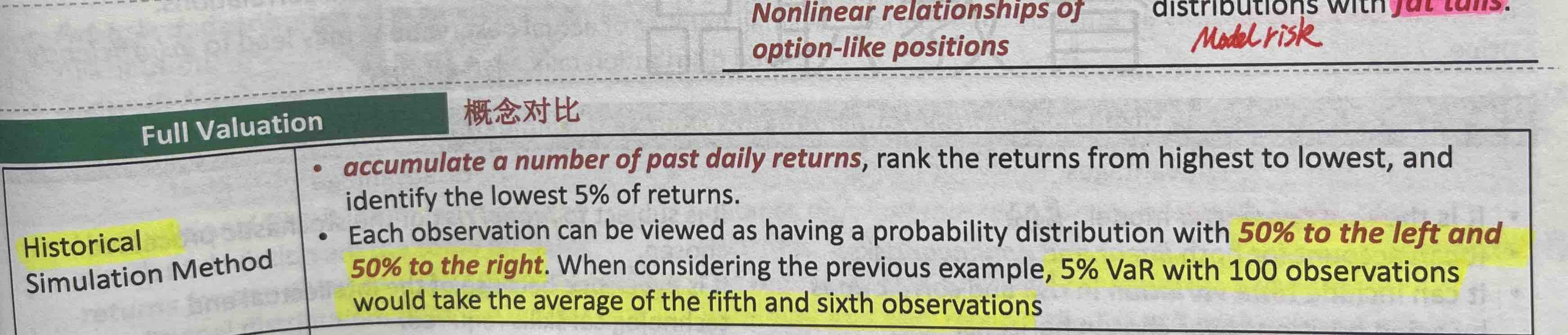

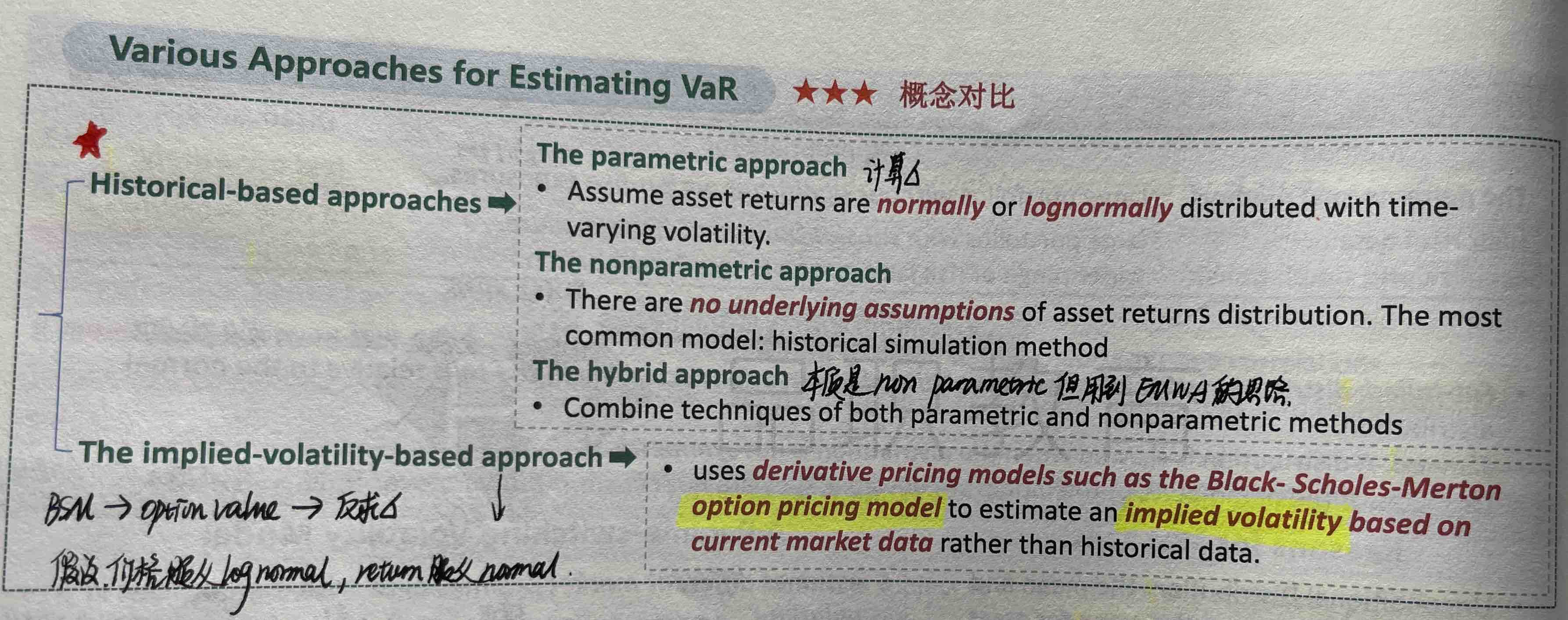

historical simulation 是通过历史的风险因子对价格的变动关系,模拟同样的风险因素用历史变动关系如何影响价格?求出的价格再计算收益率,从而用参数法或者非参数法计算war?

而不是直接用历史资产的收益率来计算var吗?

var计算的第一种划分,local 和full,full下面的historical,和第二种划分,historical based和implied中的historical是一个意思吗?