答案

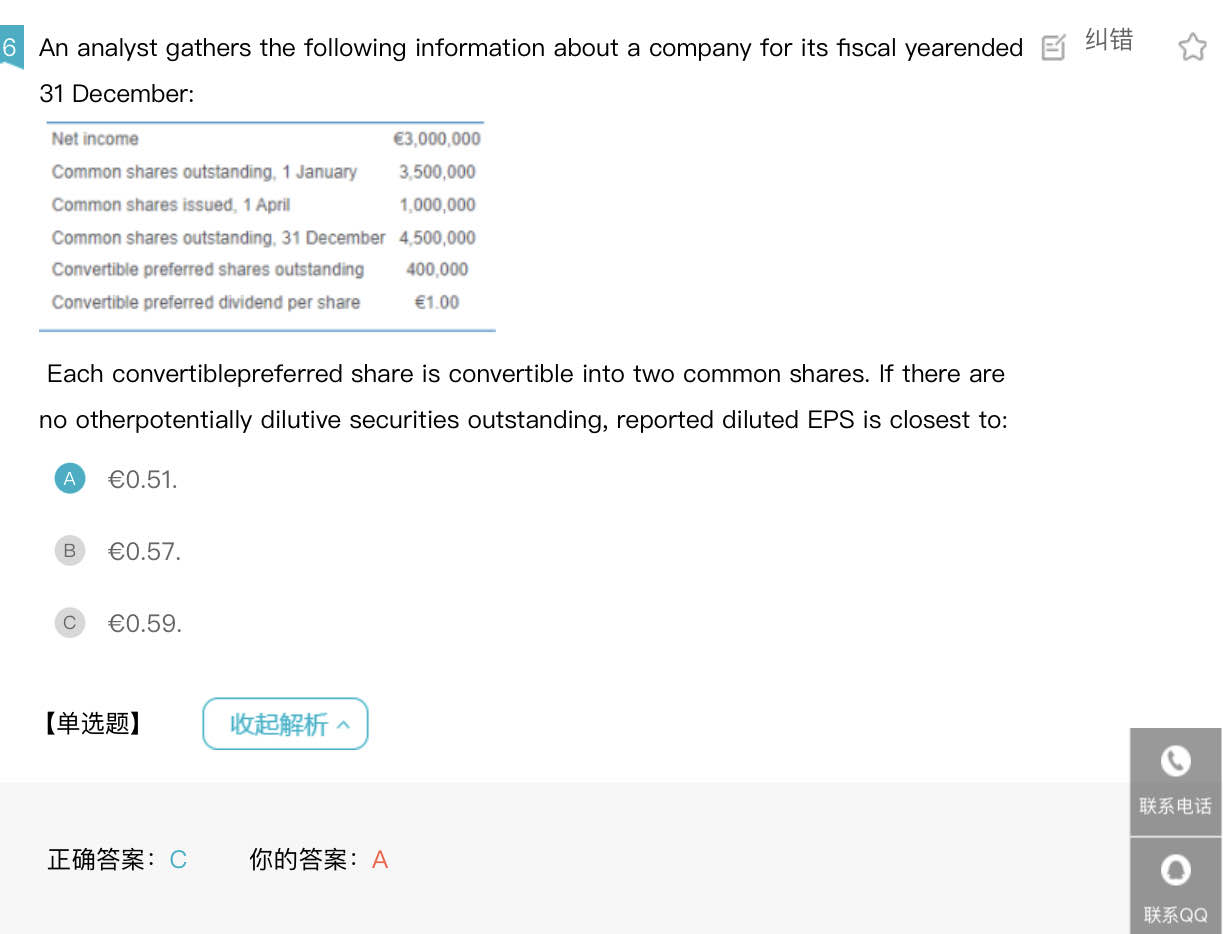

A.Incorrect because the preferred dividends are subtracted from the numerator. DilutedEPS ≠ (Net income – Preferred dividends) / (Weighted average number of common shares + Newcommon shares issued at conversion) = (€3,000,000 − €400,000) / (4,250,000 + 800,000) = €0.5149≈ €0.51. B

.Incorrect because the 31 December number of common shares outstanding is usedinstead of the weighted average number of common shares during the calendar year. Diluted EPS ≠(Net income) / (31 December number of common shares outstanding + New common shares issuedat conversion) = €3,000,000 / (4,500,000 + 800,000) = €0.5660 ≈ €0.57.

C.Correct because DilutedEPS = Net income / (Weighted average number of common shares + New common shares issued atconversion); and Weighted average number of common shares during the year = 3,500,000 +1,000,000 × ¾ = 4,250,000, which reflects the shares issued on April 1 which are outstanding for 9 ofthe 12 months of the year. New shares issued at conversion = 400,000 × 2 = 800,000. Diluted EPS =€3,000,000 / (4,250,000 + 800,000) = €3,000,000 / 5,050,000 = €0.5941 ≈ €0.59. Basic EPS = (Netincome – Preferred dividend) / Weighted average common shares= (€3,000,000 −€400,000)/4,250,000 = €2,600,000 / 4,250,000 = €0.6118. The convertible preferred shares are notanti-dilutive, as €0.59 is less than basic EPS €0.6118. Thus the reported diluted EPS is €0.59.