NO.PZ2023081403000086

问题如下:

Q. Which of the following is a difference between a stock grant and a stock option grant?选项:

A.Whereas the fair value of stock grants is usually based on the market value at the date of the grant, the fair value of option grants must be estimated. B.Companies account for stock grants by allocating compensation expense over the employee service period, whereas compensation expense for stock options is expensed immediately. C.Compensation expense is determined based on the market value of a share of stock on the grant date, whereas the measurement date for the value of an option is when the employee exercises the option.解释:

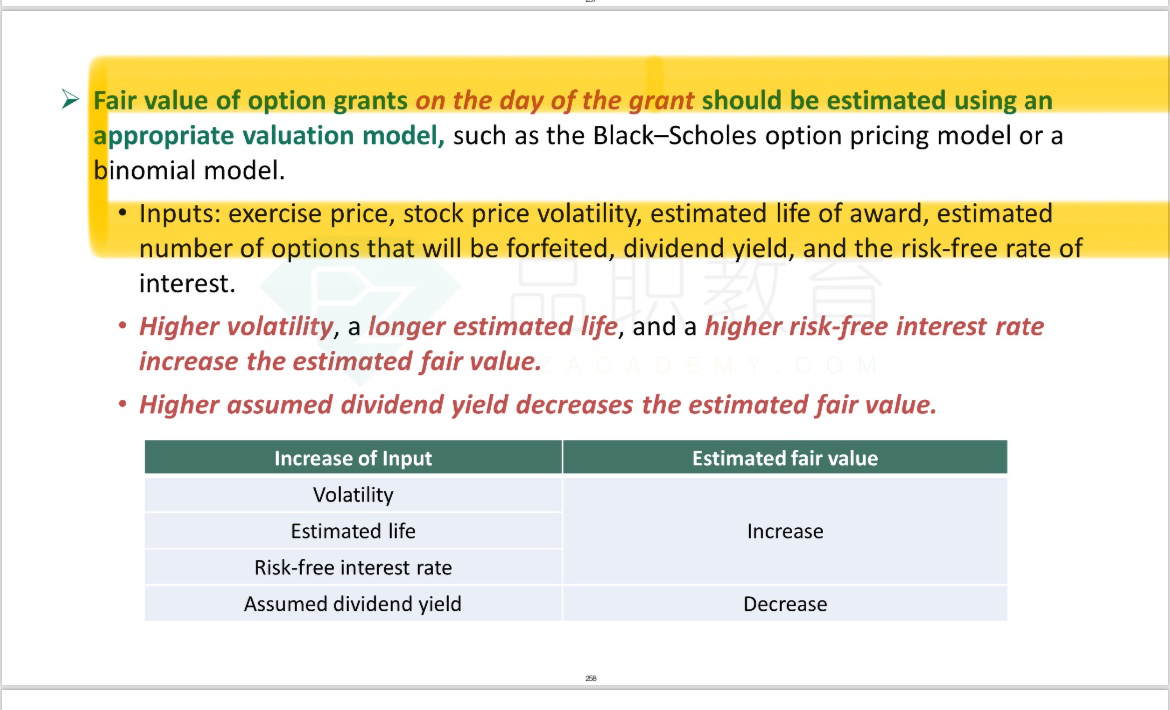

A is correct. The compensation for a stock grant is based on the market value at the date of the stock grant. For a stock option, the value is not definitively known and must be estimated. Answer B is not correct because companies account for both stock grants and option grants by allocating the value of the grant over the service period (often the vesting period). Answer C is not correct because for both a share grant and an option grant, the value of the grant is determined based on the date of the grant.

C.补偿费用是根据授予日股票的市值确定的,而期权价值的计量日是员工行使期权时。前半句是对的,期权也是赠予日当天的FV入账。

---- 期权在当日没有FV,也不一定能estimated出来,怎么在初始日计量呢。