NO.PZ2023102101000046

问题如下:

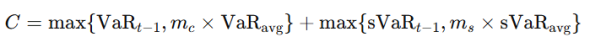

The following formula defines the capital requirement (c) under theinternal models approach to the calculation of market risk under Basel III:

C = max {VaRt-1, mc × VaRavg} + max {sVaRt-1, ms × sVaRavg}

About this calculation, each of the following is trueEXCEPT which is false?

选项:

A.

The first term is the higher of (i) the previous day’sVaR and (ii) an average of the daily VaR measures on each of the precedingsixty business days, multiplied by a multiplication factor

B.

The second term is the higher of (i) the latestavailable stressed VaR and (ii) an average of the stressed VaR numbers over thepreceding sixty business days, multiplied by a multiplication factor

C.

The multiplication factors m(c) and m(s) will be setby individual supervisory authorities but subject to an absolute minimum ofthree (3)

D.

The bank can choose to conduct an ex-post backtest onthe stressed VaR only; if the test is successful, both multiplicative factorscan be reducted to one

解释:

The ex-post backtest applies only to the VaR,not the stressed VaR. Further, the backtest increases (via a “plus”) the m(c)factor by a factor of zero to 1.0; it does not reduce the minimum of3.0.Essentially, a yellow-zone backtest result can imply a minimum factor,m(c), of at least four (4.0=3.0+1.0), or more if the supervisor requires.

To review, the capital requirement (c) isgiven by the following formula:

C = max {VaRt-1, mc × VaRavg} + max {sVaRt-1, ms × sVaRavg}

i.e., the sum of:

The higher of (1) its previous day’svalue-at-risk number, VaR(t-1); and (2)an average of the daily value-at-riskmeasures on each of the preceding sixty business days, VaR(avg), multiplied bya muitiplication factor, m(c),plus

The higher of (1) its latest avaliablestressed-value-at-risk sVaR(t-1); and (2)an average of the stressedvalue-at-risk over the preceding sixty business days, sVaR(avg), multiplied bya muitiplication factor, m(s)

In regard to (A), (B) and (C), each is true.

这道题能讲一下吗 没看懂