NO.PZ2023091701000054

问题如下:

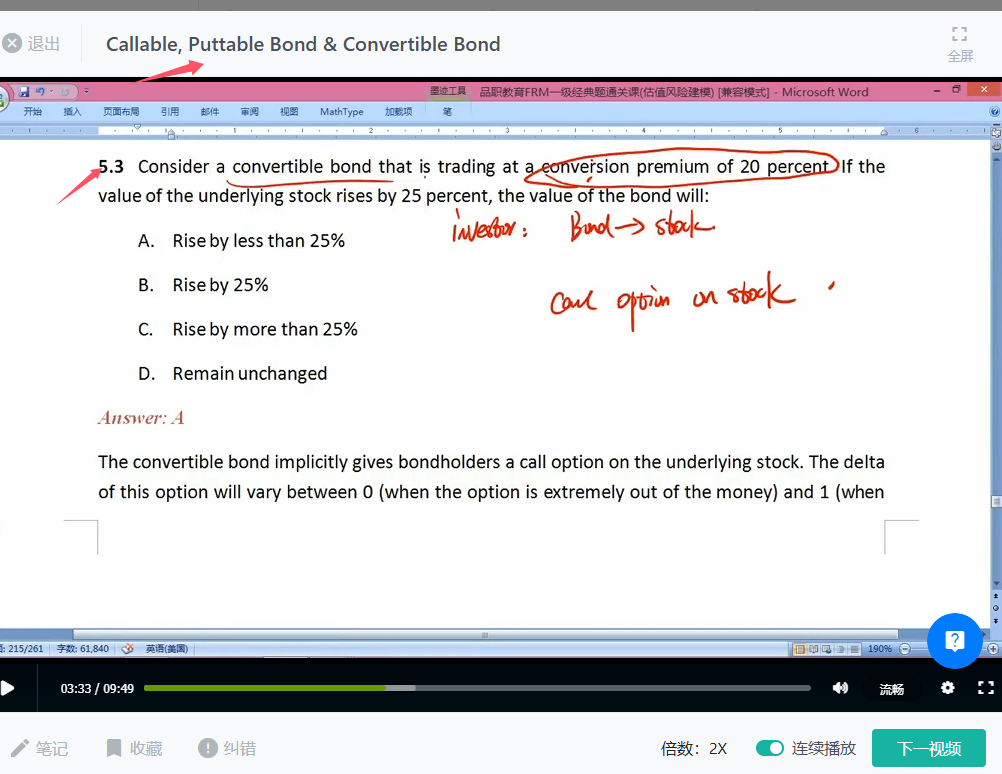

Consider a convertible bond that is trading at a conversion premium of 20 percent. If the value of the underlying stock rises by 25 percent, the value of the bond will:

选项:

A.Rise by less than 25% B.Rise by 25% C.Rise by more than 25% D.Remain unchanged解释:

The convertible bond implicitly gives bondholders a call option on the underlying stock. The delta of this option will vary between 0 (when the option is extremely out of the money) and 1 (when the option is extremely in the money). In this case, the bond is trading at a conversion premium of 20% so the delta must be somewhere between zero and one, and hence the price of the convertible bond will rise by less than the price of the underlying stock.

请问这道题经典题讲解里面有吗?