NO.PZ2023041003000036

问题如下:

Suppose you observe a non-

dividend- paying Australian equity trading for A$7.35. The call and put options

have two years to mature, the periodically compounded risk- free interest rate

is 4.35%, and the exercise price is A$8.0. Based on an analysis of this equity,

the estimates for the up and down moves are u = 1.445 and d = 0.715,

respectively.

Calculate

the European- style call and put option hedge ratios at Time Step 0 and Time

Step 1. Based on these hedge ratios, interpret the component terms of the

binomial option valuation model.

解释:

The computation of

the hedge ratios at Time Step 1 and Time Step 0 will require the option values

at Time Step 1 and Time Step 2. The terminal values of the options are given in

Solution 1.

S++ = u2S

= 1.4452(7.35) = 15.347

S+– =

udS = 1.445(0.715)7.35 = 7.594

S– – =

d2S = 0.7152(7.35) = 3.758

S+ = uS

= 1.445(7.35) = 10.621

S– = dS

= 0.715(7.35) = 5.255

Therefore, the

hedge ratios at Time 1 are

In the last hedge

ratio calculation, both put options are in the money (p–+ and p– –). In this

case, the hedge ratio will be –1, subject to a rounding error. We now turn to

interpreting the model’s component terms. Based on the no- arbitrage approach,

we have for the call price, assuming an up move has occurred, at Time Step 1

• C+ = hc+S+ + PV1,2 (- hc+S+- +C+-)-=

0.9476(10.621) + (1/1.0435)[–0.9476(7.594) + 0.0] = 3.1684

Thus, the call

option can be interpreted as a leveraged position in the stock. Specifically,

long 0.9476 shares for a cost of 10.0645 [= 0.9476(10.621)] partially financed

with a 6.8961 {= (1/1.0435)[–0.9476(7.594) + 0.0]} loan. Note that the loan

amount can be found simply as the cost of the position in shares less the

option value [6.8961 = 0.9476(10.621) – 3.1684]. Similarly, we have

• C-= hc–S- + PV1,2 (- h c–S-- +C--)-= 0.0(5.255) + (1/1.0435)[–0.0(3.758) + 0.0] =

0.0

Specifically, long

0.0 shares for a cost of 0.0 [= 0.0(5.255)] with no financing.

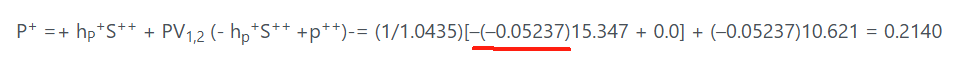

For put options,

the interpretation is different. Specifically, we have

P+ =+ hP+S++

+ PV1,2 (- hp+S++

+p++)-=

(1/1.0435)[–(–0.05237)15.347 + 0.0] + (–0.05237)10.621 =

0.2140

Thus, the put

option can be interpreted as lending that is partially financed with a short

position in shares. Specifically, short 0.05237 shares for a cost of 0.55622 [=

(–0.05237)10.621] with financing of 0.77022 {=

(1/1.0435)[–(–0.05237)15.347 + 0.0]}. Note that the lending amount can be

found simply as the proceeds from the short sale of shares plus the option

value [0.77022 = (0.05237)10.621 + 0.2140]. Again, we have

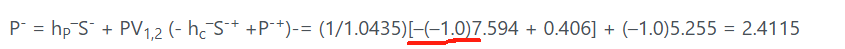

P- = hP–S-

+ PV1,2 (- hc–S-+

+P-+)-=

(1/1.0435)[–(–1.0)7.594 + 0.406] + (–1.0)5.255 = 2.4115

Here, we short 1.0

shares for a cost of 5.255 [= (–1.0)5.255] with financing of 7.6665 {=

(1/1.0435)[–(–1.0)7.594 + 0.406]}. Again, the lending amount can be found

simply as the proceeds from the short sale of shares plus the option value

[7.6665 = (1.0)5.255 + 2.4115].

Finally, The

interpretations remain the same at Time Step 0: c = hcS + PV0,1(–hcS–

+ c–) =

The

interpretations remain the same at Time Step 0:

C=hcS+

PV0,1 (-hcS-+C-)-=

0.5905(7.35) + (1/1.0435)[–0.5905(5.255) + 0.0] = 1.37

Here, we are long

0.5905 shares for a cost of

4.3402 [=0.5905(7.35)] partially financed with

a 2.97 {= (1/1.0435)[–0.5905(5.255) + 0.0] or = 0.5905(7.35) – 1.37} loan.

P = hPS+

PV0,1 (-hPS++P+)=

(1/1.0435){–[–0.4095(10.621)] + 0.214} + (–0.4095)7.35 = 1.36

Here, we short

0.4095 shares for a cost of 3.01 [= (–0.4095)7.35] with financing of 4.37 (=

(1/1.0435){–[–0.4095(10.621)] + 0.214} or = (0.4095)7.35 + 1.36).

为什么put option ITM,hedge ratio就是-1而舍弃另一个-0.05