NO.PZ2023100703000020

问题如下:

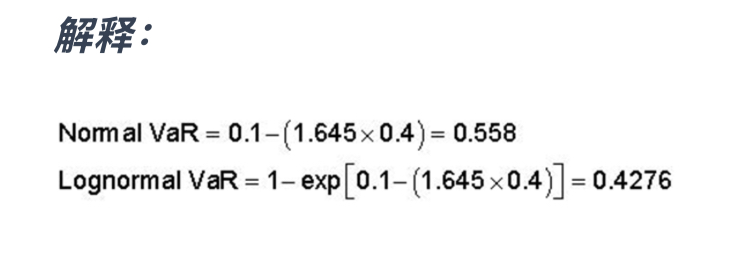

The annual mean and volatility of a portfolio are 10% and 40%, respectively. The current value of the portfolio is GBP 1,000,000. How does the 1-year 95% VaR that is calculated using a normal distribution assumption (normal VaR) compare with the 1-year 95% VaR that is calculated using the lognormal distribution assumption (lognormal VaR)?选项:

A.Lognormal VaR is greater than normal VaR by GBP 130,400 B.Lognormal VaR is greater than normal VaR by GBP 17,590 C.Lognormal VaR is less than normal VaR by GBP 130,400 D.Lognormal VaR is less than normal VaR by GBP 17,590解释:

13.04%怎么来的