NO.PZ2023091802000060

问题如下:

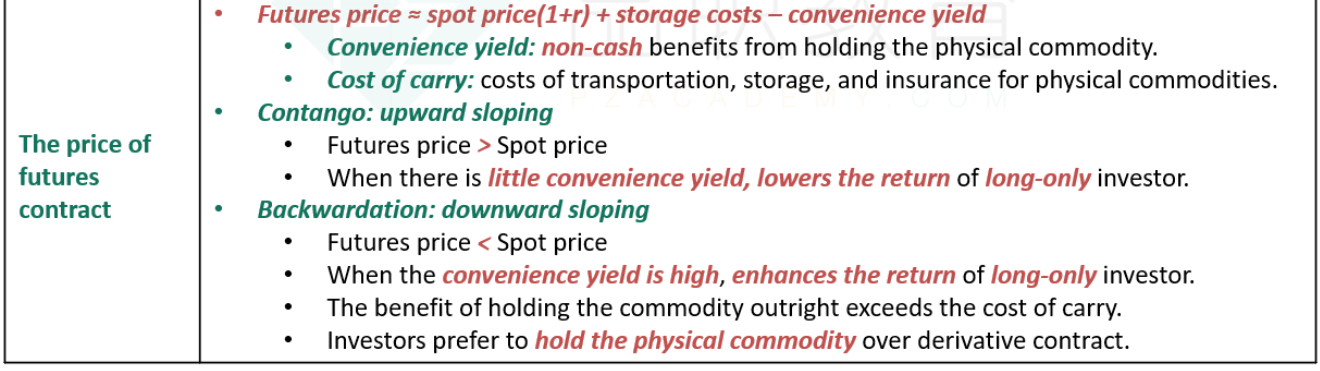

In commodity markets, the complex relationships between spot and forward prices are embodied in the commodity price curve. Which of the following statements is true?

选项:

A.In a backwardation market, the discount in forward prices relative to the spot price represents a positive yield for the commodity supplier.

B.In a backwardation market, the discount in forward prices relative to the spot price represents a positive yield for the commodity consumer.

C.In a contango market, the discount in forward prices relative to the spot price represents a positive yield for the commodity supplier.

D.In a contango market, the discount in forward prices relative to the spot price represents a positive yield for the commodity consumer.

解释:

When forward prices are as a discount to spot prices, a

backwardation market is said to exist. The relatively high spot price

represents a convenience yield to the consumer that holds the commodity for immediate consumption.

请问能讲解一下题目吗?