NO.PZ2023100703000006

问题如下:

A risk manager is estimating the market risk of a portfolio using both the arithmetic return with normal distribution assumption and the geometric returns with lognormal distribution assumptions. The manager gathers the following data on the portfolio: • Annualized average of arithmetic returns: 15% • Annualized standard deviation of arithmetic returns: 35% • Annualized average of geometric returns: 0.3% • Annualized standard deviation of geometric returns: 44% • Current portfolio value: EUR 4,800,000 • Trading days in a year: 252 Assuming both daily arithmetic returns and daily geometric returns are serially independent, which of the following statements is correct?选项:

A.1-day normal 95% VaR=4.45% and 1-day lognormal 95% VaR=3.57% B.1-day normal 95% VaR=3.57% and 1-day lognormal 95% VaR=4.45% C.1-day normal 95% VaR=4.45% and 1-day lognormal 95% VaR=4.49% D.1-day normal 95% VaR=3.57% and 1-day lognormal 95% VaR=3.55%解释:

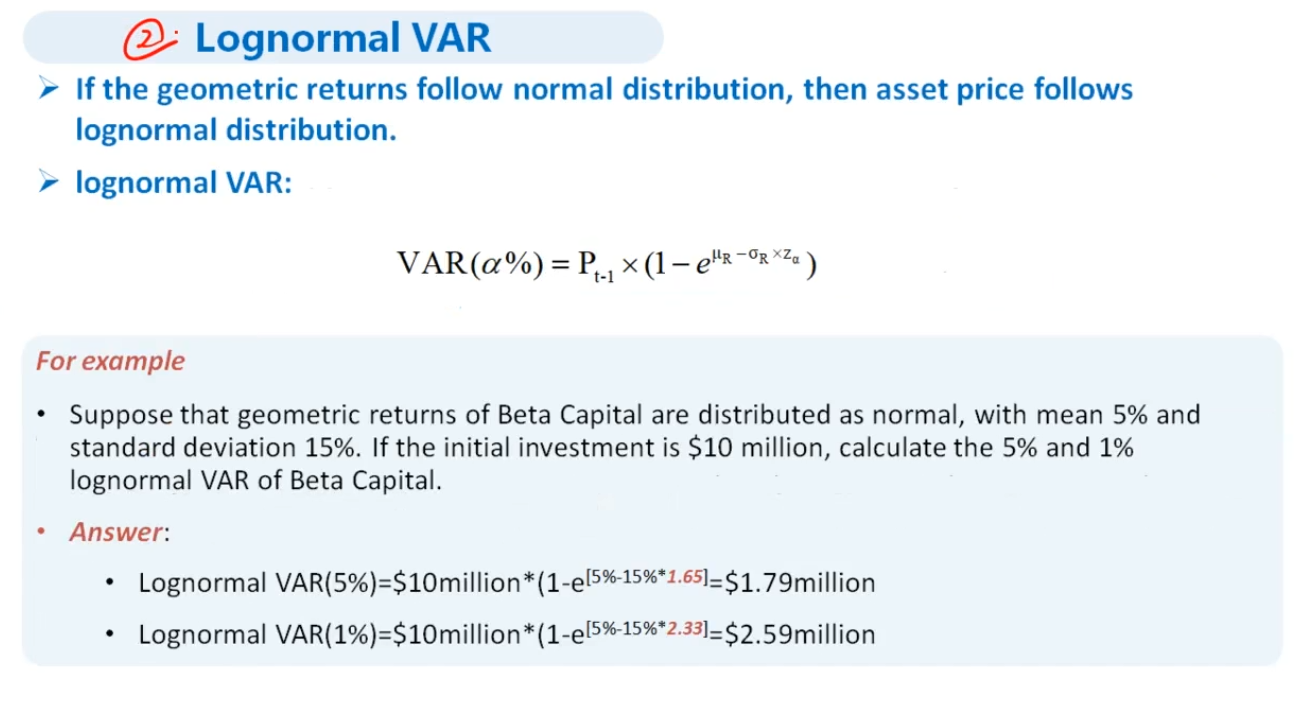

1-day normal 95% VaR=-[(0.15/252)-1.645*0.35/sqrt(252)]=3.57% 1-day lognormal 95% VaR=1-exp(0.003/252-0.44*1.645/sqrt(252))=4.45%lognormal的是怎么算的