NO.PZ2023100703000098

问题如下:

A CRO of a hedge fund is asking the risk team to develop a term-structure model that is appropriate for fitting interest rates for use in the fund’s options pricing practice. The risk team is evaluating several interest rate models with time-dependent drift and time-dependent volatility functions. Which of the following is a correct description of the specified model?选项:

A.In the Ho-Lee model, the drift of the interest rate process is presumed to be constant. B.In the Ho-Lee model, when the short-term rate is above its long-run equilibrium value, the drift is presumed to be negative. C.In the Cox-Ingersoll-Ross model, the basis-point volatility of the short-term rate is presumed to be proportional to the square root of the rate, and short-term rates cannot be negative. D.In the Cox-Ingersoll-Ross model, the volatility of the short-term rate is presumed to decline exponentially to a constant long-run level.解释:

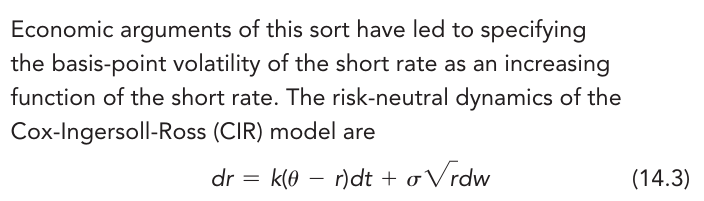

C is correct. In the CIR model, the basis-point volatility of the short rate is not independent of the short rate as other simpler models assume. The annualized basis-point volatility equals σ*sqart(r). Short-term rate in the CIR model cannot be negative because of the combined property that (i) basis-point volatility equals zero when short -term rate is zero, and (ii) the drift is positive when the short-term rate is zero. A is incorrect. In the Ho-Lee model, the drift of the interest rate process is presumed to be time-varying. B is incorrect. No long-run equilibrium value is defined in the Ho-Lee model. D is incorrect. The volatility of the short-term rate is assumed to be proportional to the square root of the short-rate in the CIR model.CIR模型的short rate为什么不能为负?