NO.PZ2024101802000019

问题如下:

A client’s limited partnership stake in a venture that invests in office buildings throughout Asia has been revalued such that this stake is now worth 30% less than estimated at the time the IPS was written. Assume that, prior to the revaluation, this stake accounted for 10% of the total market value of the portfolio and was worth EUR10 million, the target strategic allocation for global real estate securities. The lower bound for rebalancing is 8%. The next annual review of the IPS is scheduled in nine months. Which response below best describes the next IPS review?

选项:

A.The next IPS review should take place in nine months as scheduled

The next IPS review should be rescheduled as soon as possible with a focus on capital sufficiency analysis

The next IPS review should be rescheduled as soon as possible to review the asset allocation of the portfolio

解释:

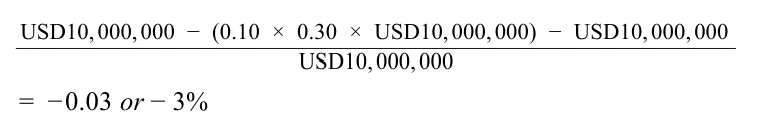

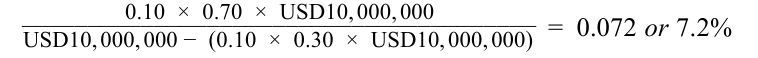

Given the assumption on the initial size of the limited partnership stake, the decline in the total portfolio value is just 3%, so a capital sufficiency analysis is unnecessary. Moreover, the allocation to Global Real Estate Securities declines to 7.2% (from 10%), so it is just below the 8% lower rebalancing limit for this asset class — see calculations below. Therefore, the next IPS review should be rescheduled as soon as possible to review the asset allocation of the portfolio with a view towards rebalancing. Decline in total portfolio value is -3%, Allocation to global real estate securities is 7.2%

A is incorrect because significant changes in market conditions, such as the revaluation of the limited partnership stake, can create the need for an IPS review earlier than a scheduled once per year review. B is incorrect because the couple can tolerate portfolio volatility, and the decline in total portfolio value is just 3%, so a focus on the capital sufficiency analysis should not be a necessary aspect of the next IPS review.

请问答案说明中7.2%是什么运算逻辑,不应该是7%么?