NO.PZ2023101902000040

问题如下:

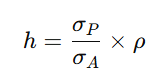

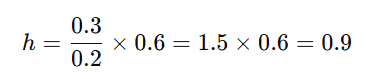

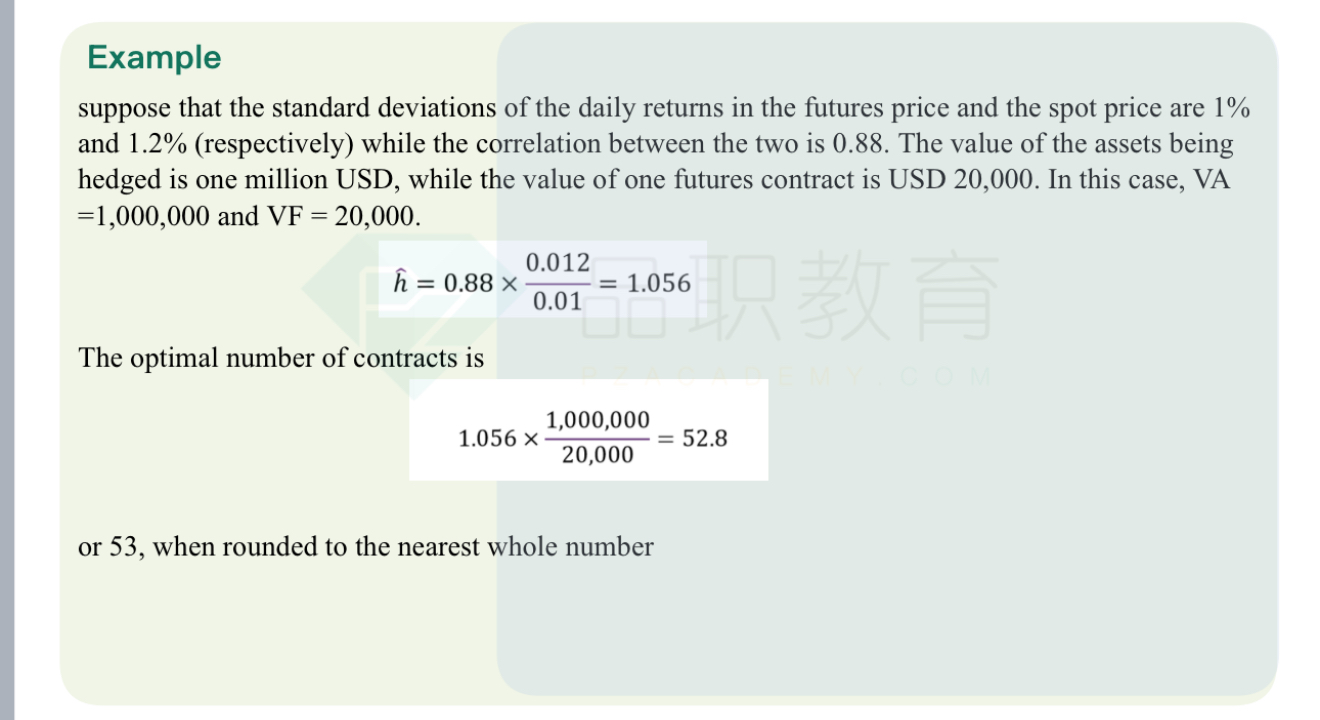

4.7 A risk manager wishes to fully hedge a GBP 100 million equity portfolio with a standard deviation of returns of 30% per year by using Asset A with a standard deviation of returns of 20% per year. The returns of the equity portfolio and Asset A are jointly normally distributed and have a correlation of 0.6. How much of Asset A will have to be sold short to accomplish this hedge?选项:

A.GBP 18 million B.B. GBP 33 million C.GBP 90 million D.GBP 150 million解释:

请讲解