NO.PZ2023100905000035

问题如下:

The treasurer of a US bank is

concerned about potential future interest rate increases by the Federal Reserve

(FED) and their impact on the bank’s net worth. After reviewing the bank’s

stress testing framework, the treasurer asks a manager to consider including an

additional scenario in which the FED increases interest rates by 200 bps and to

perform duration analysis on the scenario. The manager gathers information on

the bank’s balance sheet and the duration of each asset and liability item as

provided below:

Assuming the current

level of interest rates is 2%, which of the following is a correct statement

for the manager to make regarding this stress scenario?

选项:

A.A 200-bps increase in interest rates will cause the bank’s net worth to decrease by USD 27.4 million.

B.A 200-bps increase in interest rates will cause the bank’s net worth to decrease by USD 52.4 million.

C.Compared to the bank’s other balance sheet items, interest-bearing deposits will experience the smallest change in value given a 200-bps increase in interest rates.

D.In this scenario, utilizing USD 200 million of cash to first pay off USD 200 million of other borrowings in response to a 200-bps increase in interest rates will cause the value of the bank’s net worth to increase.

解释:

A is correct.

The duration of the

bank’s assets and liabilities are as follows:

D Assets: (400 x 0 +

400 x 1 + 600 x 5 + 1100 x 3)/2500 = 2.68

D Liabilities: (1000

x 0.5 + 1200 x 4)/2200 = 2.41

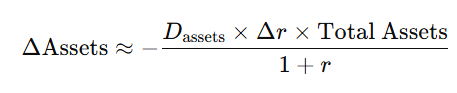

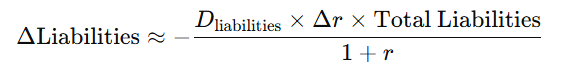

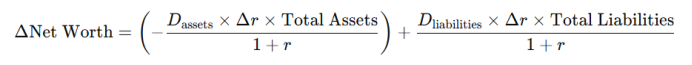

And the effect of a

200 bps increase in interest rates on the bank’s net worth can be calculated as

follows:

-(2.68 x 0.02 x

2500)/1.02 – (-2.41 x 0.02 x 2200)/1.02 = -131.37 + 103.96 = -27.41

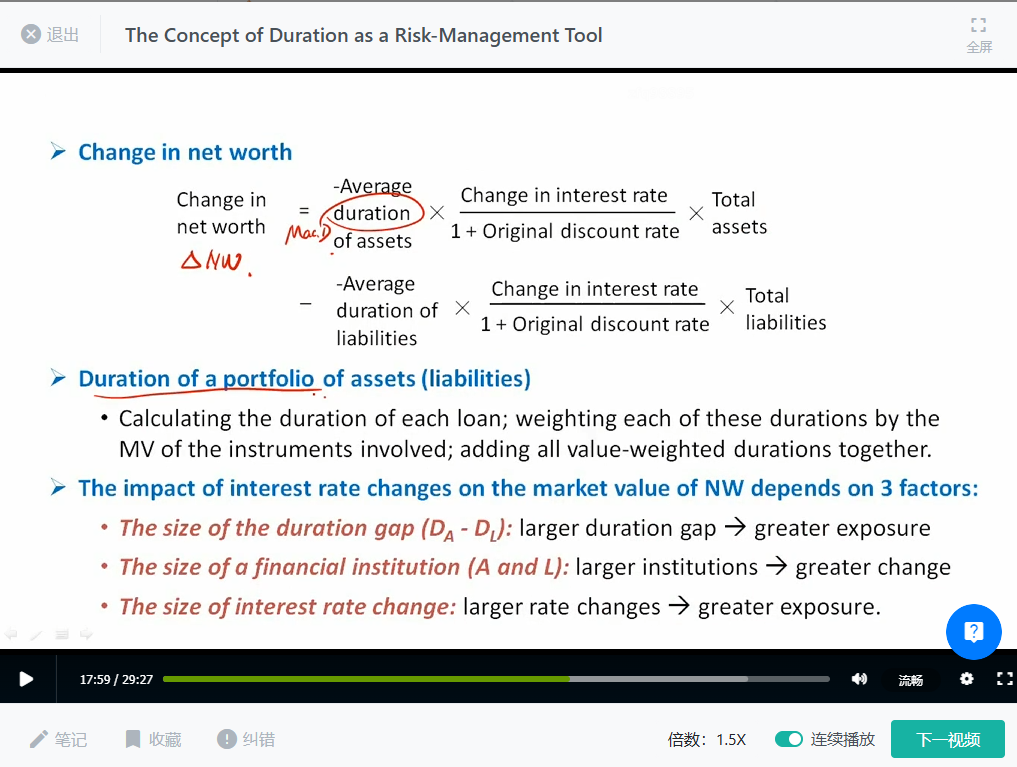

除以1.02是什么意思?默认duration是麦考利duration?

还有D选项错在哪里了?