NO.PZ2023100703000018

问题如下:

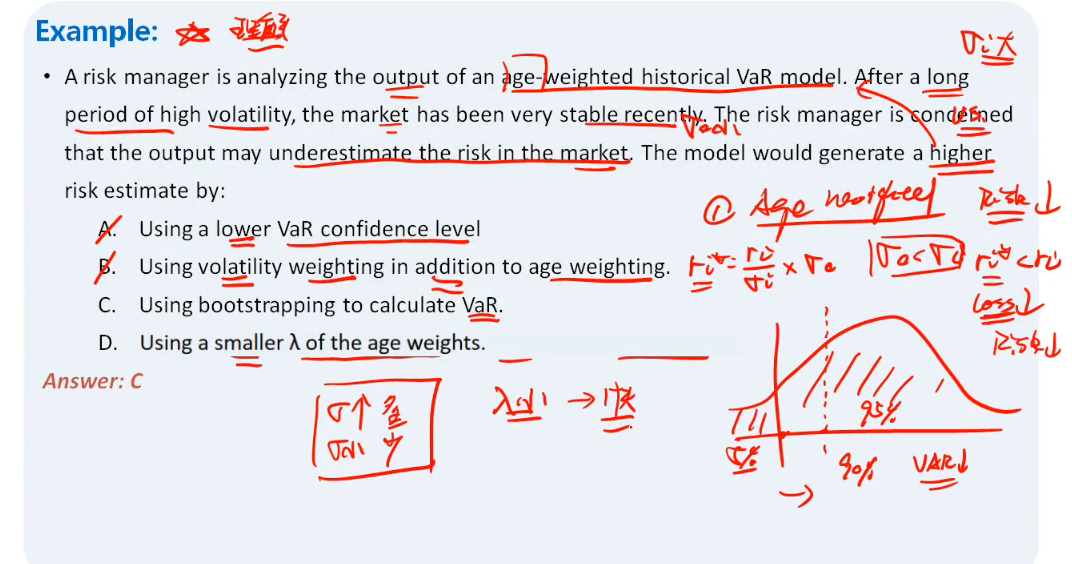

A risk manager is analyzing the output of an age-weighted historical VaR model. After a long period of high volatility, the market has been very stable recently. The risk manager is concerned that the output may underestimate the risk in the market. The model would generate a higher risk estimate by:选项:

A.Using a lower VaR confidence level B.Using volatility weighting in addition to age weighting. C.Using bootstrapping to calculate VaR. D.Using a smaller exponential rate of decay of the age weights.解释:

Using bootstrapping will give more weight to periods of high volatility. Therefore, if there was a period of high volatility in the past, its importance will be emphasized more, potentially leading to a higher risk estimate.

D选项用Age weighted方法衰减降低,历史波动大的数据一样可以高估风险啊