NO.PZ2023091901000106

问题如下:

An enterprise risk manager at a large US-based bank is reviewing the bank’s stress testing and scenario analysis approaches to recommend potential improvements. The manager prepares a presentation describing some benefits of stress testing and scenario analysis as well as the regulatory and historical context of these two approaches. Which of the following statements is correct?

选项:

A.Sensitivity testing involves substituting several key variables with alternative variables to explore risk model results under stressful conditions.

B.Scenario analysis is used to model the effects that abnormal events and events with no historical data could have on the bank’s performance.

C.In the Comprehensive Capital Analysis and Review (CCAR) stress test, banks with assets above USD 50 billion are limited to the use of a single severely adverse scenario developed by supervisors.

D.Scenario analysis that included the assessment of the impact of cumulative exposures across multiple business lines were widely used across the banking industry even prior to the 2007-2009 financial crisis.

解释:

B is correct. Scenario analysis helps firms model the enterprise impact of abnormal events and events for which there is no historical data.

A is incorrect. Stress testing involves changing one or more key variables to explore risk model results under stressful conditions. Sensitivity testing explores the sensitivity of a risk model to changes in a given variable and does not involve substituting some variables with others.

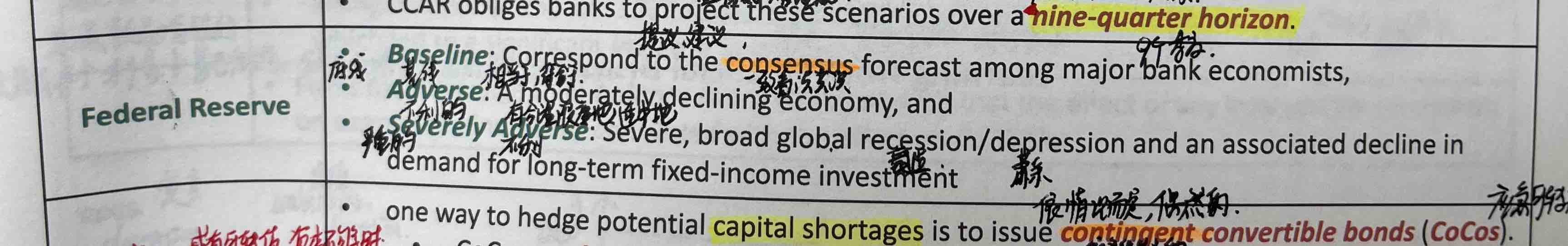

C is incorrect. The Comprehensive Capital Analysis and Review (CCAR) stress test in the US is conducted at the end of the year for banks with assets above USD 50 billion. The Federal Reserve requires banks to utilize three supervisor-devised macroeconomic scenarios: baseline, adverse and severely adverse. CCAR also obliges banks to generate their own scenarios to complement the supervisory scenarios.

D is incorrect. Bank scenario analysis was not well constructed and did not include the impact of cumulative exposures across multiple business prior to the financial crisis. After the crisis, it became apparent that banks often failed to consider factors such as the cumulative exposures across multiple business lines, how different risks interacted with one another, and how the behavior of market participants might change under stress.

B正确。情景分析帮助企业建立异常事件和没有历史数据的事件对企业影响的模型。

A不正确。压力测试包括改变一个或多个关键变量,以探索压力条件下的风险模型结果。敏感性测试探索风险模型对给定变量变化的敏感性,不涉及用其他变量替换某些变量。

C选项不正确。美国的综合资本分析和审查(CCAR)压力测试是在年底对资产超过500亿美元的银行进行的。美联储要求银行利用监管者设计的三种宏观经济情景:基线、不利和严重不利。CCAR还要求银行生成自己的情景,以补充监管情景。

D选项不正确。银行情景分析没有很好地构建,也没有包括金融危机前多个业务累积风险敞口的影响。危机过后,很明显,银行往往没有考虑到多个业务线的累积风险敞口、不同风险之间的相互作用,以及市场参与者的行为在压力下可能发生的变化等因素。

老师,听了B选项的视频讲解,也就是图里的“Federal Reserve”的三种情况仅是针对CCAR情况吗?