NO.PZ2022061307000080

问题如下:

Question

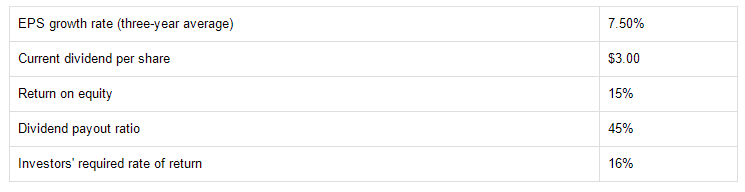

The following data pertain to a company that can be appropriately valued using the Gordon growth model. The dividend is expected to grow indefinitely at the existing sustainable growth rate.

The stock’s intrinsic value is closest to:

选项:

A.$34.62. B.$37.94. C.$41.90.解释:

Solution

C is correct. V0=D0(1+g)r/g where

Sustainable growth rate = g = b × ROE

b = (1 – Payout ratio)

g = (1 – 0.45) × 15% = 8.25%

V0 = ($3 × 1.0825)/(0.16 – 0.0825) = $41.90

A is incorrect. It uses payout ratio instead of retention ratio (b) to compute sustainable growth rate

g = 0.45 × 15% = 6.75%

V0 = $3(1.0675)/(0.16 – 0.0675) = $34.62

B is incorrect. It uses the EPS growth instead of sustainable growth rate.

V0 = $3(1.075)/(0.16 – 0.075) = $37.94

好容易记混……