NO.PZ2024022701000166

问题如下:

Enterprise value is most likely associated with:选项:

A.multiplier models. B.present value models. C.asset-based valuation models.解释:

Solution-

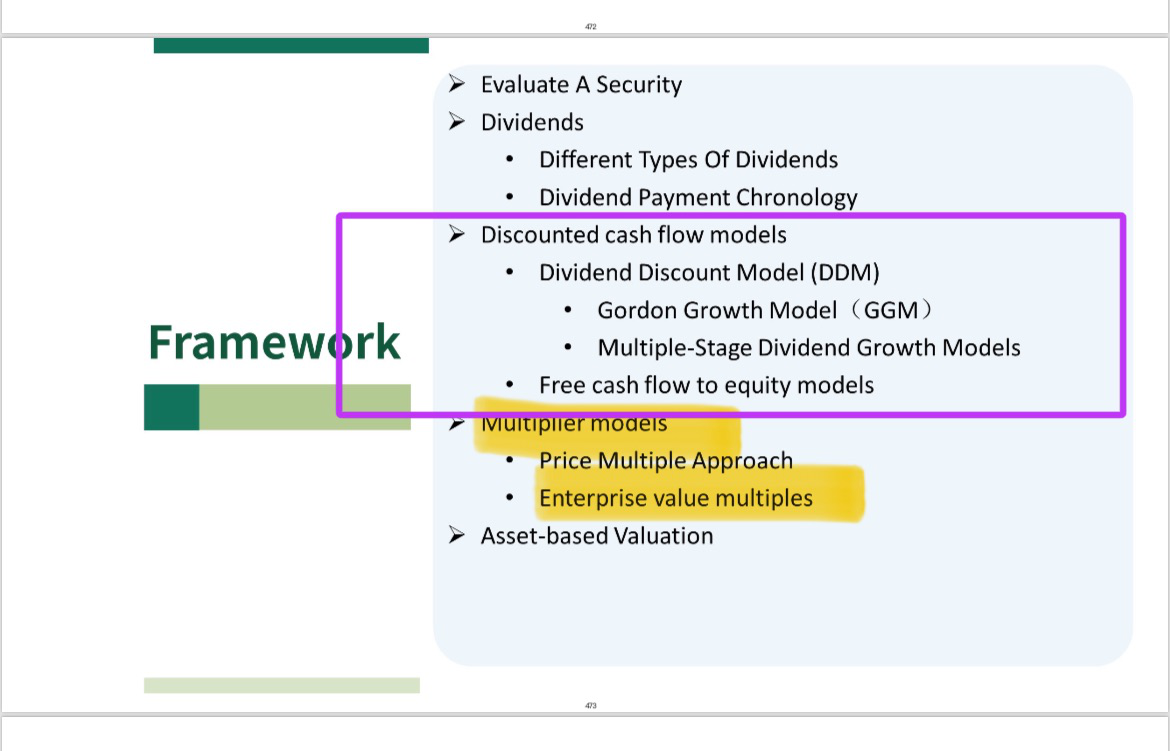

Correct because multiplier models are based chiefly on share price multiples or enterprise value multiples. Enterprise value (EV) multiples have the form (Enterprise value)/(Value of a fundamental variable). Two possible choices for the denominator are earnings before interest, taxes, depreciation, and amortization (EBITDA) and total revenue.

-

Incorrect because present value models estimate the intrinsic value of a security as the present value of the future benefits expected to be received from the security. In present value models, benefits are often defined in terms of cash expected to be distributed to shareholders (dividend discount models) or in terms of cash flows available to be distributed to shareholders after meeting capital expenditure and working capital needs (free-cash-flow-to-equity models).

-

Incorrect because asset-based valuation models estimate intrinsic value of a common share from the estimated value of the assets of a corporation minus the estimated value of its liabilities and preferred shares. The estimated market value of the assets is often determined by making adjustments to the book value (synonym: carrying value) of assets and liabilities. The theory underlying the asset-based approach is that the value of a business is equal to the sum of the value of the business's assets.

•

如题