NO.PZ2023032701000043

问题如下:

Yee gathers the following information to estimate the equity value:

• 2013 FCFF will be $600 million.

• Beyond 2013, FCFF will grow in perpetuity at 4% annually.

• The market value and book value of McLaughlin’s long-term debt are approximately equal.

• Weighted average cost of capital (WACC)=9.0%

• Number of outstanding shares (millions)=411

• Long-term debt at the end of 2012=$2,249 million

Using Yee’s assumptions and the FCFF valuation approach, the year-end 2012 value per share of McLaughlin common stock is closest to:

选项:

A.$23.73

$12.78

$29.20

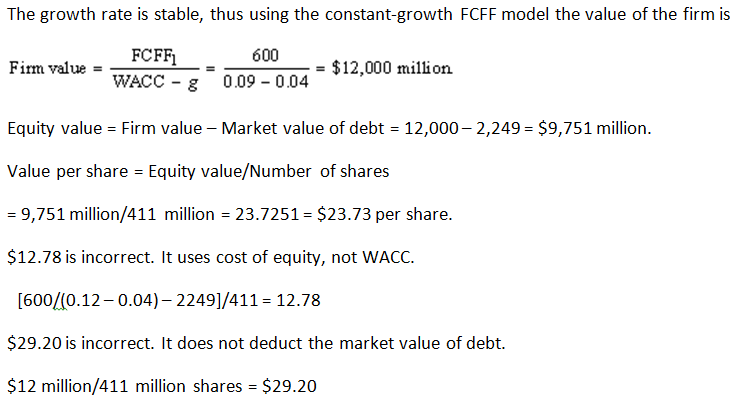

解释:

想问该题中"Beyond 2013"我从字面上的理解是从2014年开始才永续增长。所以答案中V2012的价值是不是得先用FCFF2013x(1+r)/(r-g)算出V2013,再去折回到V2012呢?

还是说Beyond 2013这个用的不太严谨呢?

谢谢