NO.PZ2024042601000087

问题如下:

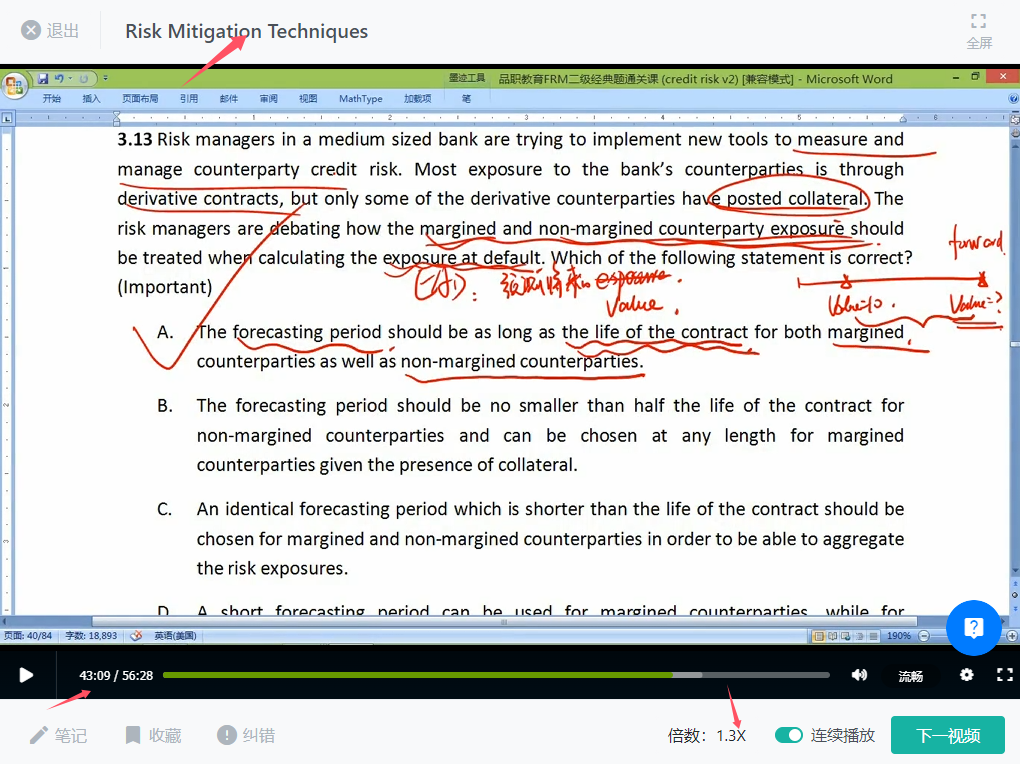

Risk managers in a medium sized bank are trying to implement new tools to measure and manage counterparty credit risk. Most exposure to the bank’s counterparties is through derivative contracts, but only some of the derivative counterparties have posted collateral. The risk managers are debating how the margined and non-margined counterparty exposure should be treated when calculating the exposure at default. Which of the following statement is correct?

选项:

A.

The forecasting period should be as long as the life of the contract for both margined counterparties as well as non-margined counterparties

B.

The forecasting period should be no smaller than half the life of the contract for non-margined counterparties and can be chosen at any length for margined counterparties given the presence of collateral

C.

An identical forecasting period which is shorter than the life of the contract should be chosen for margined and non-margined counterparties in order to be able to aggregate the risk exposures

D.

A short forecasting period can be used for margined counterparties, while for non-margined counterparties it should correspond to the contract lifetime

这道题应该怎么理解?