NO.PZ2023091802000168

问题如下:

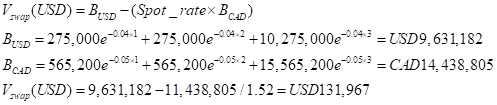

Consider the following 3-year currency swap, which involves exchanging annual interest of 2.75% on 10 million US dollars for 3.75% on 15 million Canadian dollars. The current exchange rate is 1 US dollar for 1.52 AUD.. The term structure is flat in both countries. Calculate the value of the swap in USD if interest rates in Canada are 5% and in the United States are 4%. Assume continuous compounding. Round to the nearest dollar.

选项:

A.$152,000

B.$145,693

C.$131,967

D.$127,818

解释:

which involves exchanging annual interest of 2.75% on 10 million US dollars for 3.75% on 15 million Canadian dollars.

老师好,题目说exchange USD for CAD, 不应该是指付出去USD ,收到CAD吗?为什么不用PV CAD - PV USD 呢?