NO.PZ2023091901000045

问题如下:

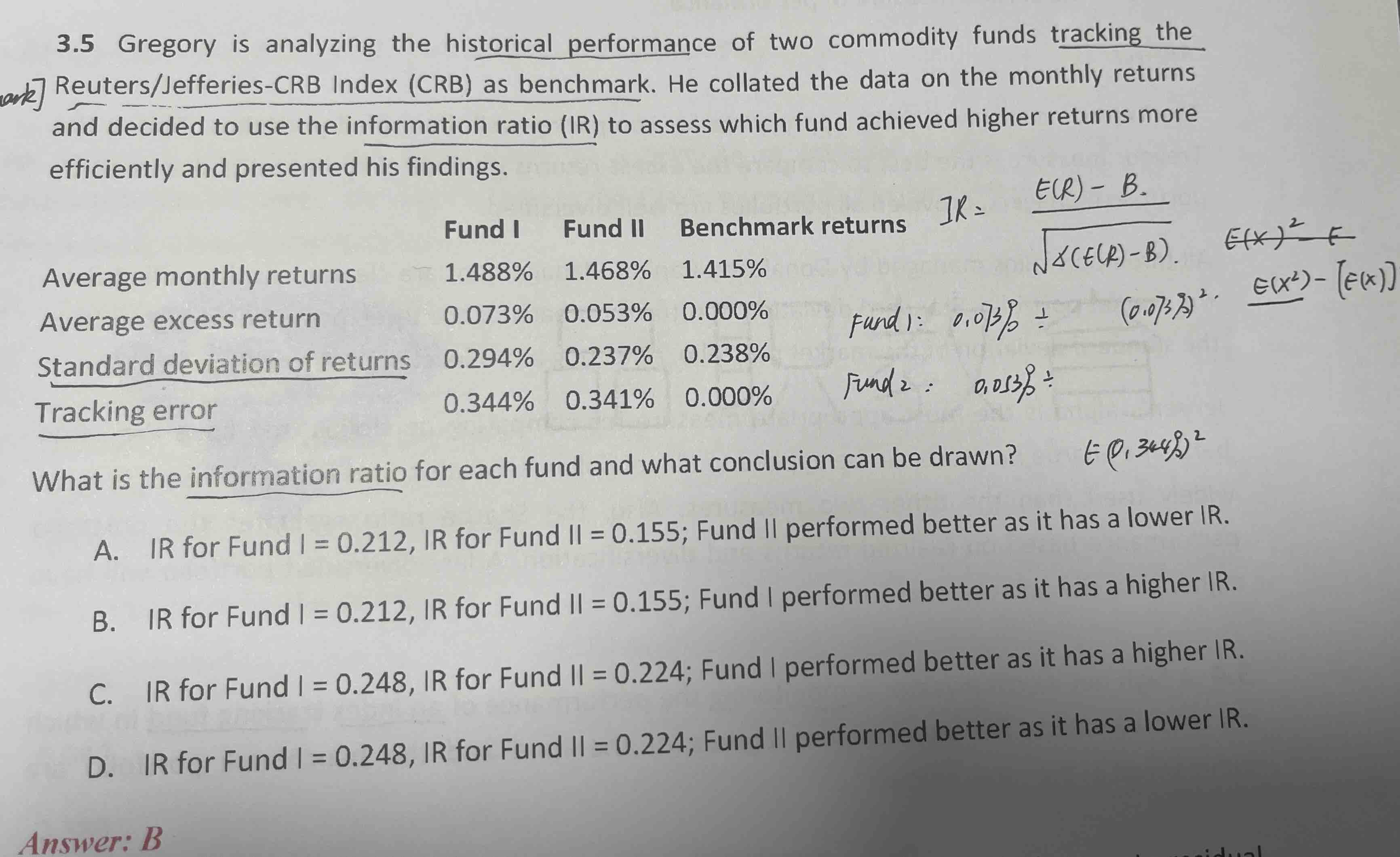

Gregory is analyzing the historical performance of two commodity

funds tracking the Reuters/Jefferies-CRB Index (CRB) as benchmark. He collated

the data on the monthly returns and decided to use the information ratio (IR)

to assess which fund achieved higher returns more efficiently and presented his

findings.

What is the

information ratio for each fund and what conclusion can be drawn?

选项:

A.

IR for Fund I = 0.212, IR for Fund II = 0.155; Fund II performed better as it has a lower IR.

B.

IR for Fund I = 0.212, IR for Fund II = 0.155; Fund I

performed better as it has a higher IR.

C.

IR for Fund I = 0.248, IR for Fund II = 0.224; Fund I performed better as it has a higher IR.

D.

IR for Fund I = 0.248, IR for Fund II = 0.224; Fund II

performed better as it has a lower IR.

解释:

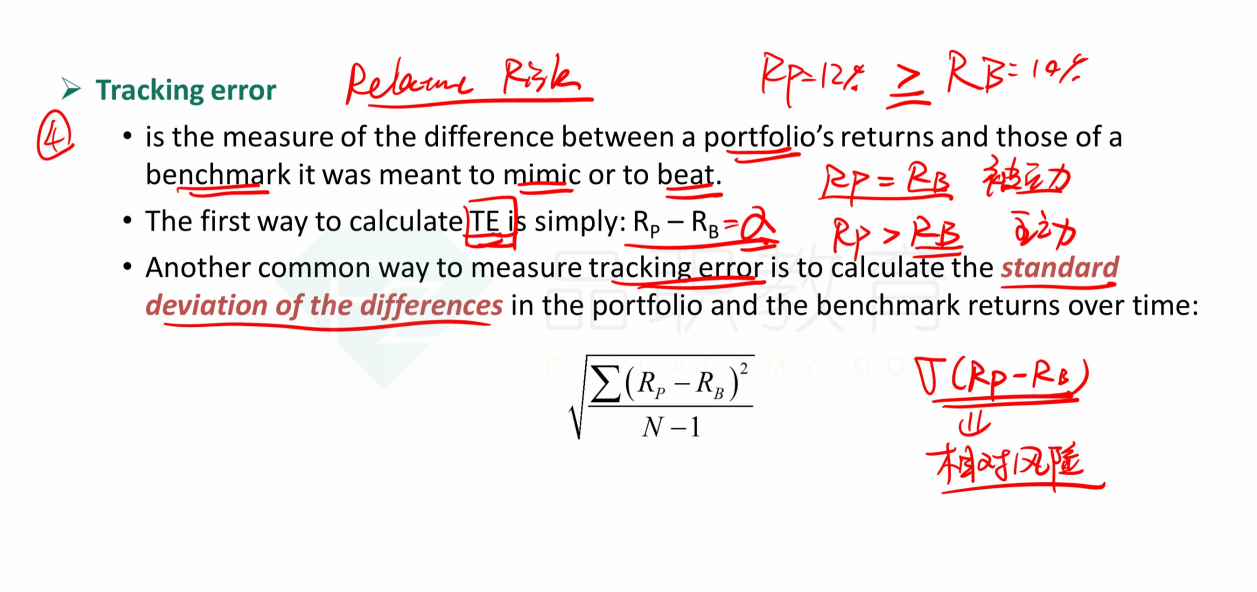

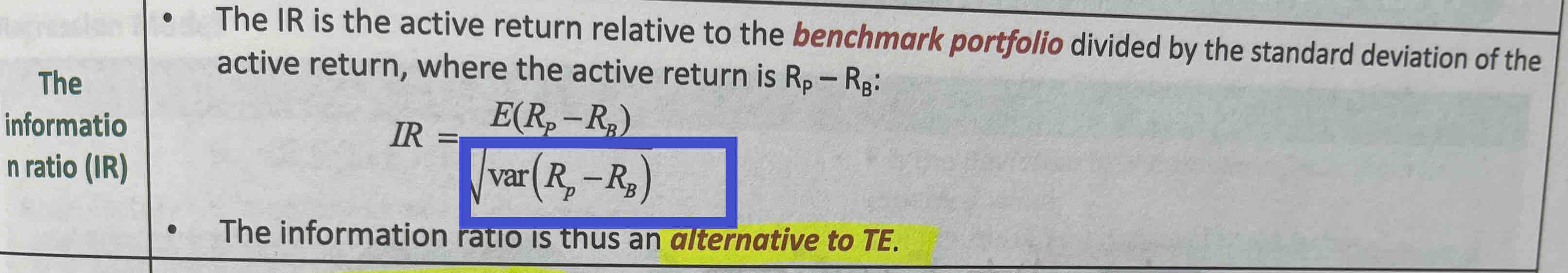

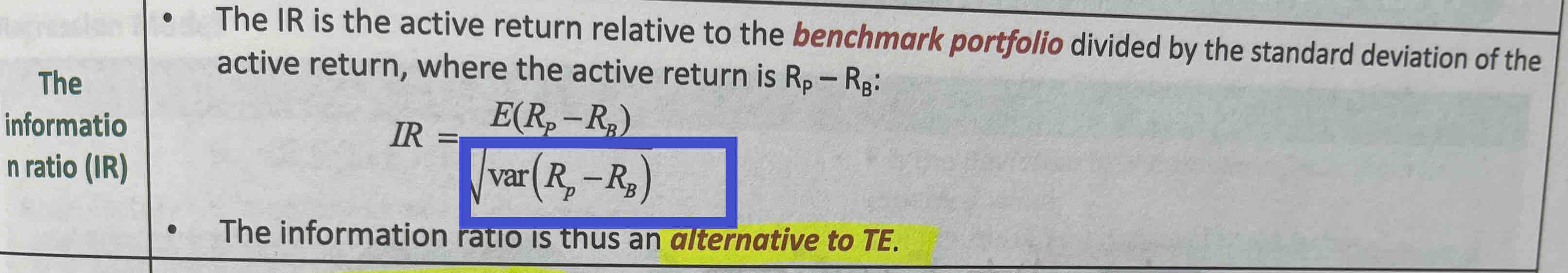

The information ratio

may be calculated by either a comparison of the residual return to residual

risk, or the excess return to tracking error. The higher the IR, the better

‘informed’ the manager is at picking assets to invest in. Since neither

residual return nor risk is given, only the latter is an option.

IR = E(Rp-Rb)/Tracking

Error

For Fund I: IR =

0.00073/0.00344 = 0.212

For Fund II: IR = 0.00053/0.00341 = 0.155

信息比率可以通过剩余收益与剩余风险的比较或超额收益与跟踪误差的比较来计算。

IR越高,说明基金经理在选择投资资产方面越“知情”。

IR = E(Rp-Rb)/跟踪误差

对于基金I: IR = 0.00073/0.00344 = 0.212

对于基金II: IR = 0.00053/0.00341 = 0.155

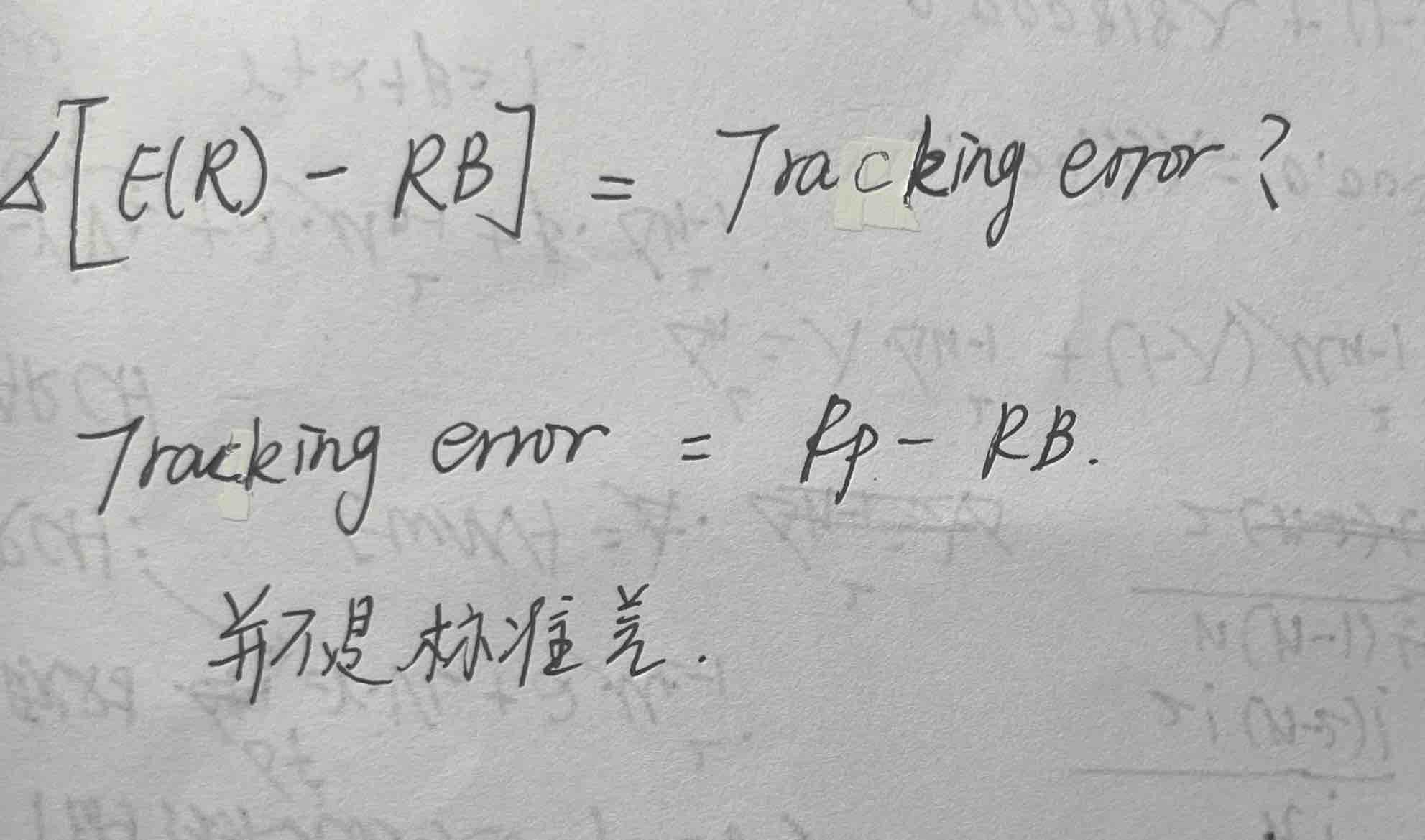

老师,为什么information ration的分母为什么是tracking error?