NO.PZ2024010507000009

问题如下:

When developing a scorecard to assess ESG risks and opportunities, which of the following is most likely a challenge for assessing a private company compared to a public company?

选项:

A.Difficulty in identifying company-specific ESG issues

B.Inability to convert qualitative factors into quantitative scores

C.Limited coverage of the ESG rating agencies of the private companies

解释:

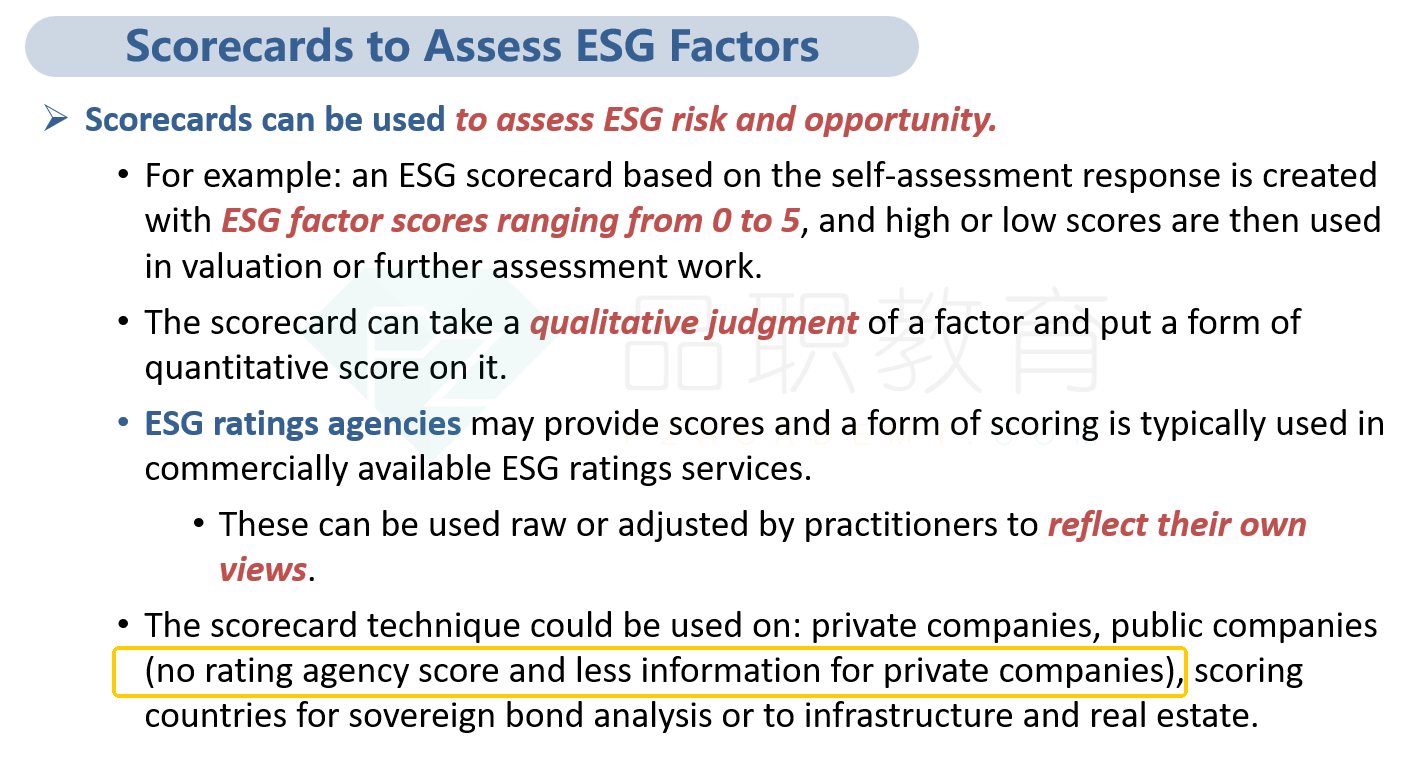

C is correct. Developing a scorecard to assess ESG risks and opportunities can be a technique used on private and public companies. The challenge to creating private company scorecards is that there is less likely to be a rating agency score for a private company and there is less information about a private company in the public domain. Identifying company-specific ESG factors and converting qualitative factors into quantitative scores would be challenges for all companies when developing an ESG scorecard.知识点在书本哪个地方?