NO.PZ2024011002000122

问题如下:

One of the notable differences between IFRS and US GAAP when dealing with income tax is best illustrated by the fundamental treatment of:选项:

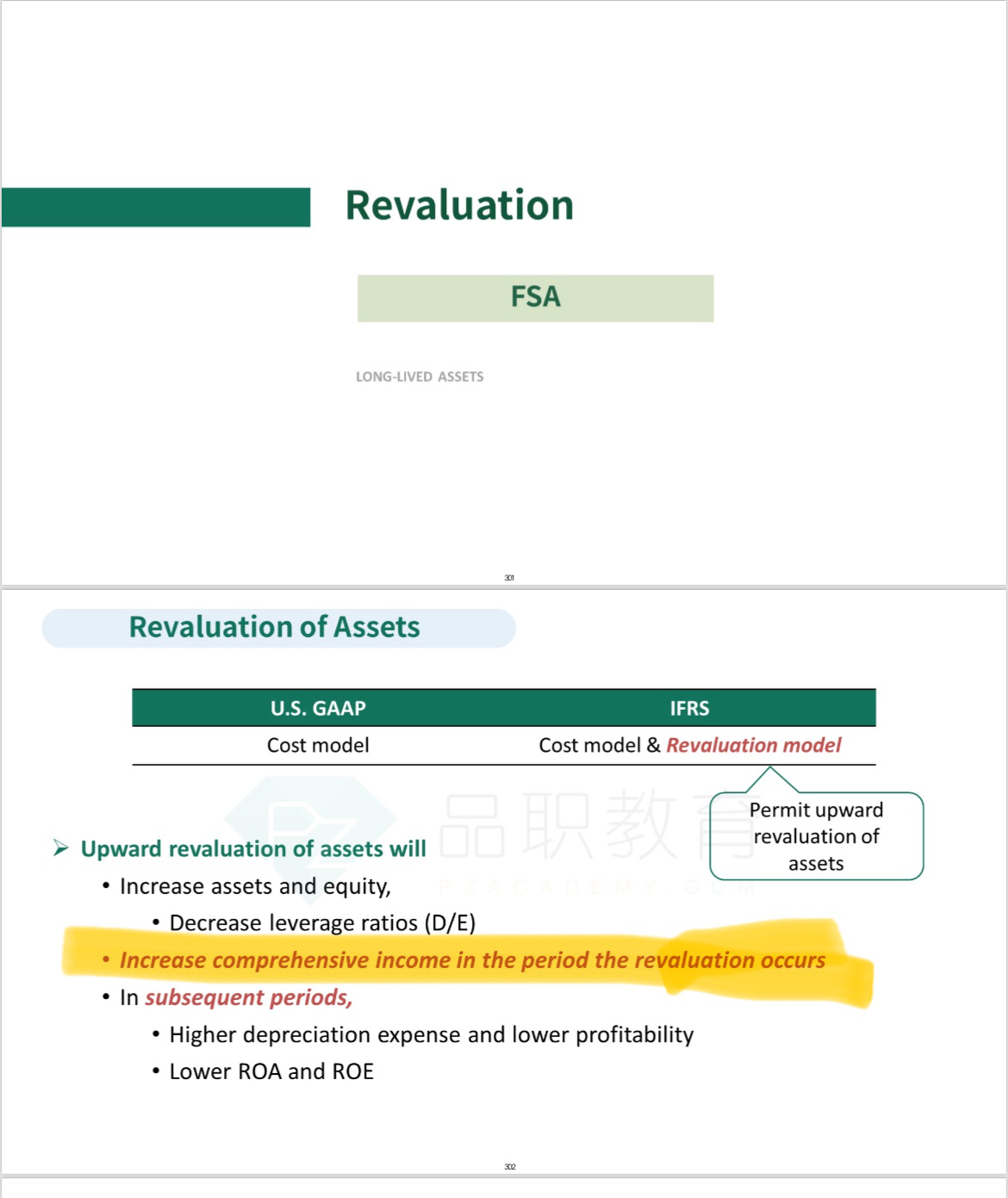

A.the revaluation of property, plant and equipment. B.non-deductible goodwill. C.temporary differences between the carrying amount and tax base of assets and liabilities.解释:

US GAAP prohibits the revaluation of PPE. Therefore, this is a source of an important difference between US GAAP and IFRS with respect to reporting of income taxes.就因为错误选项提到了Tax吗? -.-!